Automated Bots Trading

| Position | Company Logo | Information | Bonuses | Min. Dep | Regulation | Open an account |

|---|---|---|---|---|---|---|

|

|

|

Minimum Deposit: $20 |  |

||

|

|

|

Minimum Deposit: $250 |  |

||

|

|

|

Minimum Deposit: $250 |  |

||

|

4

|

|

|

Minimum Deposit: $250 |  |

||

|

5

|

|

|

Minimum Deposit: $100 |  |

||

|

6

|

|

No deposit bonus | Minimum Deposit: $5 |  |

||

|

7

|

|

|

No deposit bonus | Minimum Deposit: $10 |  |

|

|

8

|

|

|

Minimum Deposit: $250 |  |

||

|

9

|

|

No deposit bonus | Minimum Deposit: $250 |  |

||

|

10

|

|

|

No deposit bonus | Minimum Deposit: $100 |  |

|

|

11

|

|

No deposit bonus | Minimum Deposit: $10 |  |

||

|

12

|

|

|

No deposit bonus | Minimum Deposit: $25 |  |

|

|

13

|

|

|

No deposit bonus | Minimum Deposit: $100 |  |

|

|

14

|

|

No deposit bonus | Minimum Deposit: $10 |  |

||

|

15

|

|

|

No deposit bonus | Minimum Deposit: $10 |  |

|

|

16

|

|

|

No deposit bonus | Minimum Deposit: $2 |  |

|

|

17

|

|

|

No deposit bonus | Minimum Deposit: $500 |  |

Have you ever wished you could trade the financial markets 24/7 without emotions getting in the way? Automated bots trading allows you to do just that by executing trades based on pre-programmed strategies and rules. Let’s explore this fascinating world of algorithmic trading.

What is Automated Bots Trading?

Automated bots trading, also known as algorithmic trading, involves using computer programs or “bots” to automatically place buy or sell orders in the financial markets. These bots are coded with specific trading strategies that analyze market data and execute trades according to predefined rules and parameters.

For example, a trading bot could be programmed to buy a stock when its price crosses above a certain moving average line and sell when it falls below another moving average – all without any human intervention.

How Does Automated Bots Trading Work?

Automated bots trading relies on computer programs or algorithms to execute trades in the financial markets without human intervention. The process typically involves the following steps:

1. Developing a Trading Strategy

Develop a trading strategy with specific rules for entering and exiting trades. Rules are based on technical analysis indicators and patterns like moving averages, RSI, MACD, Bollinger Bands, and candlestick formations. The strategy includes risk management guidelines such as stop-loss orders, position sizing, and maximum drawdown limits.

2. Backtesting and Optimization

Backtesting a strategy using historical market data is crucial before deploying it live. Backtesting applies strategy rules to past price movements to evaluate metrics like win rate, profit factor, and maximum drawdown. Identifying flaws and fine-tuning parameters optimizes performance. Caution is needed to avoid over-optimization, which can result in curve-fitting and poor real-time outcomes.

3. Broker Integration

Once the strategy is refined, the next step is connecting the automated trading bot to a brokerage platform that provides access to live market data and order execution capabilities. This integration typically involves using the broker’s application programming interface (API) or connecting through specialized software or platforms like BinBotPro, which partners with various brokers.

4. Funding a Trading Account

To execute live trades, the trader must fund a trading account with the broker. Minimum deposit amounts vary. BinBotPro typically requires at least $250. The bot uses the capital to open and manage positions based on trading strategy signals. Capital allocation and risk management are crucial to preventing account depletion during underperformance periods.

5. Running the Bot

The trading bot can monitor and execute trades autonomously after developing, backtesting, and integrating the strategy with the broker. The bot analyzes data in real-time to find suitable opportunities. The bot operates 24/7 without human intervention, placing orders, managing stop-losses, and exiting positions automatically.

6. Monitoring and Adjustments

Bots operate independently, but traders must monitor performance, risk metrics, and account health. Assessing trade reports, profit and loss statements, and other metrics to identify issues and assess effectiveness. Traders may need to adjust the bot’s settings if its performance or market conditions change. Continuous monitoring and refinement are crucial for the bot.

Pros and Cons of Automated Bots Trading

Like any trading approach, automated bots trading has its advantages and disadvantages:

| Pros | Cons |

| Removes Human Emotions: Bots trade based on logic, not fear or greed. | Potential for Losses: Poorly designed bots can lead to substantial losses. |

| Consistency: Strategies are executed precisely without deviations. | Monitoring Required: Bots need oversight to ensure proper performance. |

| Backtesting: Strategies can be thoroughly tested on historical data. | Technical Issues: Software glitches or connectivity problems can disrupt trading. |

| Speed: Bots can react to market changes faster than humans. | Black Box Algorithms: It’s not always clear how bots make decisions. |

| 24/7 Trading: Bots can operate around the clock, even when traders sleep. | Over-Optimization: Curve-fitting strategies to past data can lead to poor live performance. |

Is Automated Bots Trading Profitable?

The profitability of automated bots trading depends on several factors, such as the quality of the trading strategy, risk management practices, and market conditions. While some traders have achieved impressive results using bots, others have experienced significant losses.

It’s essential to understand that bots trading is not a guaranteed path to riches. Like any trading approach, it requires extensive knowledge, discipline, and proper money management. Successful bots trading often involves continuous strategy refinement, adaptation, and a willingness to learn from mistakes.

How to Get Started with Automated Bots Trading

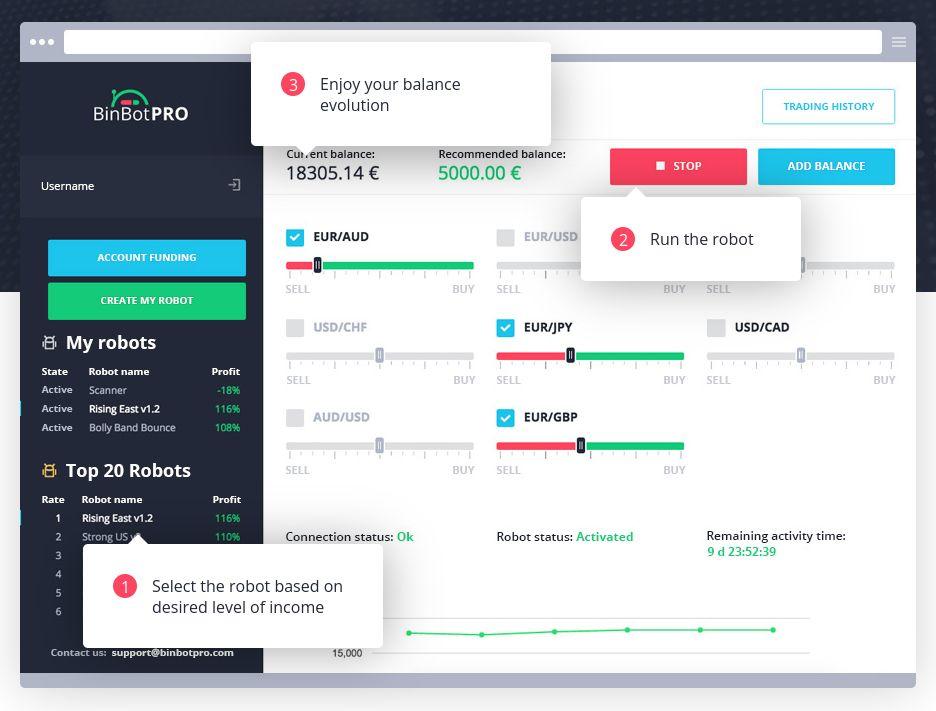

If you’re interested in exploring automated bot trading, here’s a step-by-step guide. BinBotPro is one of the best automated bot for trading binary options and forex CFDs As such, let’s take a look at how this bot works:

Step 1: Broker Integration

To access the BinBotPro automated trading bots, traders must first open a live trading account with one of these partner brokers. BinBotPro has partnered with several online brokers that offer binary options and Forex/CFD trading services. These partner brokers include IQcent, Binarycent, Videforex, and RaceOption, among others. The account opening process typically involves providing personal details, proof of identity, and making an initial minimum deposit, which is usually around $250 or more, depending on the broker.

Step 2: Bot Selection

Once a trader has funded their account with a BinBotPro partner broker, they can access the BinBotPro platform through the broker’s trading interface or client portal. The platform offers a range of pre-built, ready-made trading bots that have been developed and programmed with different strategies for various asset classes, including binary options, Forex currency pairs, and other CFD instruments like stocks, indices, and commodities.

BinBotPro provides a rating system that highlights the top-performing bots based on their recent profitability and win rates. Traders can browse through these top-rated bots and choose one that aligns with their trading preferences, risk appetite, and target assets. Alternatively, more experienced traders can create their own custom bots by combining different technical indicators, timeframes, and trading rules.

Step 3: Customization and Backtesting

Before running a selected bot live, traders have the option to customize various parameters to tailor the bot’s behavior to their specific trading needs. These customizable settings may include the choice of technical indicators (e.g., moving averages, RSI, MACD), timeframes (e.g., 5 minutes, 15 minutes, 1 hour), risk management rules (e.g., stop-loss levels, position sizing), and other trading filters or conditions.

BinBotPro also allows traders to backtest their chosen bot or customized strategy using historical market data. This backtesting feature enables traders to evaluate the bot’s performance and potential profitability over a specified time period, helping them identify any potential flaws or areas for optimization before deploying the bot with real capital.

Step 4: Automated Trading

Once a trader is satisfied with their bot’s settings and backtesting results, they can activate the bot to begin automated trading on their live account. The bot will continuously monitor the markets and execute trades autonomously based on its programmed logic and the trader’s customized parameters.

For binary options trading, the bot might place “Call” or “Put” trades based on technical signals and predefined expiry times. In the case of Forex and CFD trading, the bot can automatically open and manage long or short positions in various currency pairs, stocks, indices, or commodities based on its coded strategy.

Throughout the automated trading process, traders can monitor the bot’s performance, track open positions, review trade history, and analyze various performance metrics through the BinBotPro interface or their broker’s trading platform.

Step 5: Monitoring and Adjustments

While the beauty of automated bots trading lies in its ability to execute trades without human intervention, it’s essential for traders to regularly monitor their bot’s performance and make necessary adjustments when needed. This may involve analyzing the bot’s win rate, profit factor, maximum drawdown, and other risk metrics to identify potential issues or areas for improvement.

If the bot’s performance deviates significantly from expectations or if market conditions change, traders may need to make adjustments to the bot’s settings, such as tweaking indicator parameters, modifying risk management rules, or even switching to a different bot strategy altogether. Continuous monitoring and refinement are crucial to ensure the bot remains effective and adapts to changing market dynamics.

Step 6: Risks and Considerations

It’s important to note that while BinBotPro provides a convenient platform for automated bots trading, the partner brokers facilitating the trading accounts are currently unregulated, which poses additional risks. Traders should exercise caution and conduct thorough due diligence before entrusting their funds with these brokers.

Additionally, automated bots trading, while offering potential benefits like consistency and round-the-clock execution, also carries inherent risks. These include the possibility of substantial losses due to factors such as poorly designed strategies, technical glitches, or unforeseen market events. Proper risk management, including the use of stop-losses and position sizing, is essential to mitigate potential losses.

Conclusion

Automated bots trading offers an intriguing way to participate in the financial markets by leveraging computer algorithms to execute trades based on predefined strategies. While the potential for consistent, emotion-free trading is appealing, it’s crucial to approach bots trading with caution, education, and proper risk management practices.

FAQs

Is automated bots trading legal?

Yes, automated trading is generally legal, but traders must comply with applicable regulations and terms of service from brokers. It’s crucial to ensure that the brokers and platforms used for bots trading are legitimate and regulated where required.

Can I use automated trading bots with any broker?

Not all brokers allow or support algorithmic trading via third-party bots. It’s essential to choose a broker that explicitly permits automated trading and provides the necessary APIs or integration capabilities for connecting external bots.

How much capital is required for automated bots trading?

Capital requirements can vary depending on the broker and specific trading strategies used. However, most platforms require a minimum deposit of a few hundred dollars (e.g., $250 for BinBotPro) to start trading live with automated bots.

Can automated bots guarantee profits in trading?

No, no trading approach, including automated bots, can guarantee profits. Bots trading still involves inherent risks, and losses are possible due to factors such as poorly designed strategies, technical glitches, or unforeseen market events.

Do I need programming skills to use automated trading bots?

While having programming skills can be beneficial for developing custom bots, many platforms offer user-friendly interfaces for configuring and running pre-built bots without requiring extensive coding knowledge. However, understanding trading principles and risk management is still essential.