Binary Options Trend Reversal Strategies Guide

| Position | Company Logo | Information | Bonuses | Min. Dep | Regulation | Open an account |

|---|---|---|---|---|---|---|

|

|

|

Minimum Deposit: $20 |  |

||

|

|

|

Minimum Deposit: $250 |  |

||

|

|

|

Minimum Deposit: $250 |  |

||

|

4

|

|

|

Minimum Deposit: $250 |  |

||

|

5

|

|

|

Minimum Deposit: $100 |  |

||

|

6

|

|

No deposit bonus | Minimum Deposit: $5 |  |

||

|

7

|

|

|

No deposit bonus | Minimum Deposit: $10 |  |

|

|

8

|

|

|

Minimum Deposit: $250 |  |

||

|

9

|

|

No deposit bonus | Minimum Deposit: $250 |  |

||

|

10

|

|

|

No deposit bonus | Minimum Deposit: $100 |  |

|

|

11

|

|

No deposit bonus | Minimum Deposit: $10 |  |

||

|

12

|

|

|

No deposit bonus | Minimum Deposit: $25 |  |

|

|

13

|

|

|

No deposit bonus | Minimum Deposit: $100 |  |

|

|

14

|

|

No deposit bonus | Minimum Deposit: $10 |  |

||

|

15

|

|

|

No deposit bonus | Minimum Deposit: $10 |  |

|

|

16

|

|

|

No deposit bonus | Minimum Deposit: $2 |  |

|

|

17

|

|

|

No deposit bonus | Minimum Deposit: $500 |  |

As a binary options trader, you must be able to identify trend reversals. Traders who can successfully anticipate and capitalize on these shifts in market momentum can potentially unlock significant profit opportunities. In this comprehensive guide, we’ll explore various trend reversal trading strategies, their applications, and the tools you’ll need to navigate the dynamic binary options landscape effectively.

Types of Trend Reversal Strategies

Whle there are many trend reversal strategies you can emloy for binary options trding, here are some of the most effective ones that has proven to work:

1. Candlestick Patterns

Candlestick charts are a powerful tool for visualizing price movements and identifying potential trend reversals. The relationship between the open, close, high, and low prices over a specific time period is what creates these patterns. Traders often look for specific candlestick patterns that may signal a potential trend reversal, such as:

| Pattern | Description |

| Evening Star | A bearish reversal pattern consisting of a large green candlestick, followed by a smaller red candlestick, and then a third red candlestick that closes below the midpoint of the first green candlestick. |

| Morning Star | A bullish reversal pattern that is the opposite of the evening star, consisting of a large red candlestick, followed by a smaller green candlestick, and then a third green candlestick that closes above the midpoint of the first red candlestick. |

| Shooting Star | A bearish reversal pattern that appears at the end of an uptrend, characterized by a small real body, a long upper shadow, and little or no lower shadow. |

| Hammer | A bullish reversal pattern that appears at the end of a downtrend is characterized by a small real body, a long lower shadow, and little or no upper shadow. |

When trading binary options, these candlestick patterns can provide valuable insights into potential trend reversals, allowing traders to make informed decisions about when to enter or exit a position.

2. Support and Resistance Levels

Support and resistance levels are price points where the market has previously encountered buying or selling pressure. These levels can act as potential barriers, influencing the direction of price movements. When an asset price approaches these levels, traders may look for signs of a potential trend reversal.

To identify support and resistance levels, traders can analyze historical price data and look for areas where the price has consistently struggled to break through or has bounced back from. These levels can then be used to set entry and exit points for binary options trades.

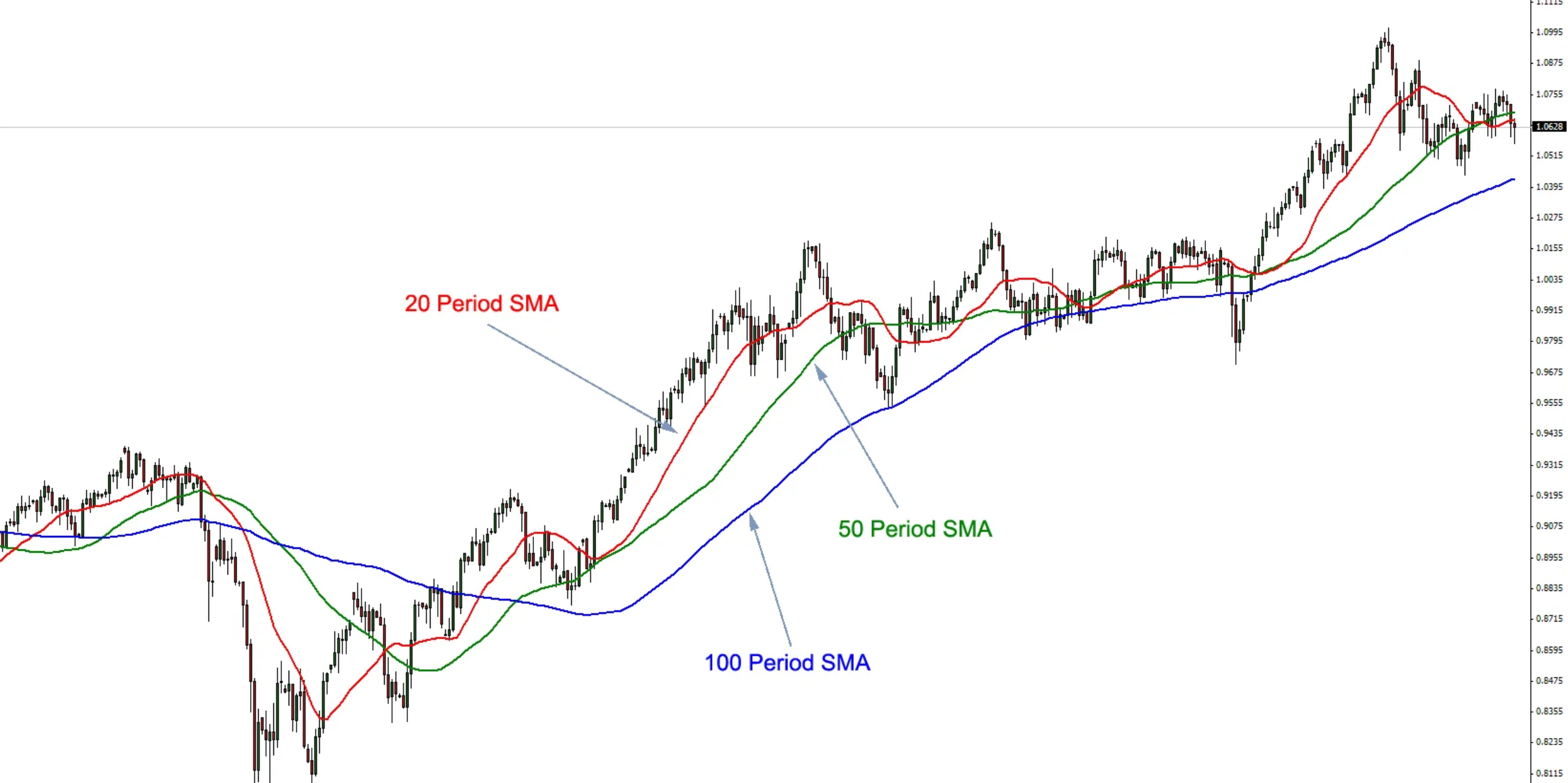

3. Moving Averages

Moving averages are widely used technical indicators that smooth out price data by calculating the average price over a specific period. Traders can use moving averages to identify potential trend reversals by observing the relationship between different moving average periods.

One common strategy involves using a shorter-term moving average (e.g., 20-period) and a longer-term moving average (e.g., 50-period). When the shorter-term moving average crosses below the longer-term moving average, it may signal a potential downward trend reversal. Conversely, when the shorter-term moving average crosses above the longer-term moving average, it may indicate a potential upward trend reversal.

4. Momentum Indicators

Momentum indicators, such as the Relative Strength Index (RSI) and stochastic, can be used to identify overbought or oversold conditions in the market. These conditions may precede a trend reversal.

The RSI is a popular momentum indicator that measures the strength of recent price movements. When the RSI value rises above 70, it indicates that the asset may be overbought, and a potential downward trend reversal could occur. Conversely, when the RSI value falls below 30, it suggests that the asset may be oversold, and a potential upward trend reversal could be on the horizon.

Stochastic is another momentum indicator that compares the closing price of an asset to its high-low range over a specific period. When the Stochastic value approaches the overbought or oversold levels (typically 80 and 20, respectively), it may signal a potential trend reversal.

5. Fibonacci Retracements

Fibonacci retracements are based on the concept that after a significant price move, the market will often retrace a certain percentage of the original move before continuing in the same direction. These retracement levels are calculated using the Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8%, and 76.4%.

Traders can use Fibonacci retracement levels to identify potential support and resistance levels where a trend reversal may occur. For example, if an asset price retraces to the 61.8% Fibonacci level after a significant uptrend, traders may anticipate a potential reversal and a continuation of the uptrend.

How to Use Fibonacci Retracements for Binary Options

To apply Fibonacci retracements in binary options trading, follow these steps:

- Identify a significant price move (either an uptrend or a downtrend).

- Draw the Fibonacci retracement levels on your chart, using the start and end points of the identified price move.

- Monitor the price action as it approaches the Fibonacci retracement levels.

- Look for potential reversal signals, such as candlestick patterns or momentum indicators, around these levels.

- If a reversal signal is confirmed, consider entering a binary options trade in the direction of the potential new trend.

Remember, Fibonacci retracements are not guaranteed to work every time, and it’s essential to combine them with other technical and fundamental analysis techniques for better decision-making.

Risk Management

While trend reversal trading strategies can be lucrative, it’s crucial to implement proper risk management techniques to protect your trading capital. Here are some essential risk management practices:

- Set a stop-loss: Determine the maximum amount you’re willing to risk on each trade and set a stop-loss order accordingly. This will help you limit potential losses if the trade goes against you.

- Use a money management strategy: Implement a money management strategy, such as risking a fixed percentage of your trading account on each trade, to ensure that you don’t over-leverage your positions.

- Diversify your trades: Don’t put all your eggs in one basket. Diversify your trades across different assets, strategies, and time frames to mitigate risk.

- Stay disciplined: Stick to your trading plan and avoid emotional decision-making. Discipline is key to successful trading, especially when dealing with trend reversals.

Start Trading with Trusted Brokers

To begin your journey in binary options trading and explore trend reversal strategies, consider partnering with reputable brokers. Here are some recommended brokers to get you started:

- IQCent: IQCent is a well-established binary options broker offering a user-friendly trading platform, a wide range of assets, and competitive pricing. They also provide educational resources and tools to help traders make informed decisions.

- Videforex: Videforex is known for its advanced trading platform, offering a variety of technical indicators and charting tools to facilitate trend analysis and identification of potential reversals.

- Raceoption: Raceoption is a popular choice among binary options traders, providing a secure and regulated trading environment, as well as a diverse selection of assets and trading tools.

- Smartytrade: Smartytrade stands out with its intuitive trading platform, offering a range of technical analysis tools and educational resources to help traders develop their trend reversal strategies.

- Binarycent: Binarycent is a reputable binary options broker that offers a user-friendly trading platform, competitive pricing, and a wide range of assets to trade.

Conclusion

Mastering trend reversal trading strategies in binary options can be a powerful tool for successful trading. By combining techniques such as candlestick patterns, support and resistance levels, moving averages, momentum indicators, and Fibonacci retracements, traders can potentially identify potential turning points in the market and capitalize on these opportunities.

However, it’s important to remember that no single strategy is foolproof, and traders should always employ proper risk management practices, stay disciplined, and continuously educate themselves on the ever-evolving binary options market.

FAQs

What is a trend reversal in binary options trading?

A trend reversal in binary options trading refers to a change in the direction of an asset’s price movement. It occurs when an uptrend (a series of higher highs and higher lows) transitions into a downtrend, or when a downtrend transitions into an uptrend.

Why is it important to identify trend reversals in binary options trading?

Identifying trend reversals is crucial in binary options trading because it allows traders to adjust their positions accordingly and potentially profit from the new trend direction. Failing to recognize a trend reversal can lead to substantial losses if a trader remains on the wrong side of the market.

Can trend reversal strategies be automated?

Yes, trend reversal strategies can be automated using trading software or robots. These automated systems can be programmed to analyze market data, identify potential trend reversals based on predefined rules, and execute trades accordingly. However, it’s essential to thoroughly test and monitor these systems to ensure they align with your trading goals and risk tolerance.

Can I use trend reversal strategies with other trading strategies?

Absolutely. Trend reversal strategies can be combined with other trading strategies, such as breakout strategies, range trading, or news trading, to create a more comprehensive and diversified trading approach. Combining multiple strategies can help traders capitalize on different market conditions and potentially increase their chances of success.

Is it necessary to use all the trend reversal strategies mentioned?

No, it’s not necessary to use all the trend reversal strategies mentioned in this guide. Traders can choose to focus on one or a combination of strategies that align with their trading style, risk tolerance, and market analysis. It’s crucial to thoroughly understand and practice the chosen strategies before implementing them in live trading.

How do I choose the right binary options broker for trend reversal trading?

When choosing a binary options broker for trend reversal trading, consider factors such as the broker’s reputation, regulatory compliance, trading platform features (e.g., charting tools, technical indicators), educational resources, and customer support. Additionally, ensure that the broker offers a wide range of assets and trading instruments suitable for your trend reversal strategies.

What are the risks involved in trend reversal trading?

Like any trading strategy, trend reversal trading carries risks. These risks include the possibility of false signals, market volatility, and unexpected events that can cause abrupt reversals. It’s essential to implement proper risk management techniques, such as setting stop-losses and managing position sizes, to mitigate potential losses.