How to trade Forex With Metatrader 5

| Position | Company Logo | Information | Bonuses | Min. Dep | Regulation | Open an account |

|---|---|---|---|---|---|---|

|

|

|

Minimum Deposit: $20 |  |

||

|

|

|

Minimum Deposit: $250 |  |

||

|

|

|

Minimum Deposit: $250 |  |

||

|

4

|

|

|

Minimum Deposit: $250 |  |

||

|

5

|

|

|

Minimum Deposit: $100 |  |

||

|

6

|

|

No deposit bonus | Minimum Deposit: $5 |  |

||

|

7

|

|

|

No deposit bonus | Minimum Deposit: $10 |  |

|

|

8

|

|

|

Minimum Deposit: $250 |  |

||

|

9

|

|

No deposit bonus | Minimum Deposit: $250 |  |

||

|

10

|

|

|

No deposit bonus | Minimum Deposit: $100 |  |

|

|

11

|

|

No deposit bonus | Minimum Deposit: $10 |  |

||

|

12

|

|

|

No deposit bonus | Minimum Deposit: $25 |  |

|

|

13

|

|

|

No deposit bonus | Minimum Deposit: $100 |  |

|

|

14

|

|

No deposit bonus | Minimum Deposit: $10 |  |

||

|

15

|

|

|

No deposit bonus | Minimum Deposit: $10 |  |

|

|

16

|

|

|

No deposit bonus | Minimum Deposit: $2 |  |

|

|

17

|

|

|

No deposit bonus | Minimum Deposit: $500 |  |

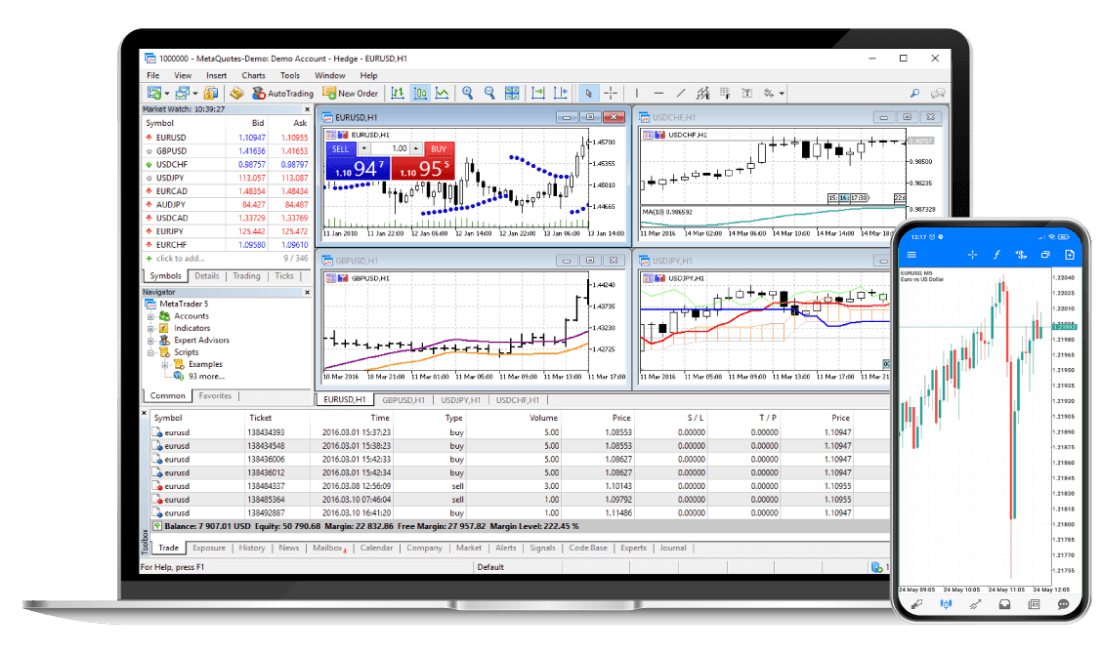

Foreign exchange (Forex) trading has become increasingly popular in recent years due to its high liquidity and 24-hour market. Many traders use the MetaTrader 5 (MT5) platform for Forex trading as it provides advanced tools and features for analyzing markets and executing trades. In this article, we will discuss key aspects of the MT5 platform and how it can be utilized for trading foreign exchange.

What is MetaTrader 5?

MetaTrader 5 (MT5) is an electronic trading platform developed by MetaQuotes Software for trading Forex, stocks, futures, and CFDs. It is the newest version of the popular MetaTrader 4 platform and contains advanced features for enhanced trading.

Some key features of the MT5 platform include:

- Advanced charting with multiple timeframes and analytical tools

- Support for algorithmic trading through Expert Advisors and indicators

- Copy trading to automatically copy successful traders

- Built-in Market and Signals for accessing trading ideas

- Backtesting trading strategies on historical data

- Trading from charts, one-click trading and trading from the Market Watch window

- Access to various order types like pending orders, market orders, stop orders etc.

The MT5 platform also provides a convenient built-in MQL5 IDE editor for developers to create Expert Advisors, indicators and scripts. Overall, its advanced functionality makes MetaTrader 5 well-suited for Forex trading.

Pros and Cons of Using MT5 for Forex Trading

Here are some of the main benefits and drawbacks of using the MetaTrader 5 platform for trading Forex:

| Pros | Cons |

| Automated trading: The MT5 platform supports Expert Advisors (EA), which are programs that automate trading strategies. This allows traders to execute trades automatically based on programmed logic. | Steep learning curve: The platform has many advanced features that can overwhelm beginner traders. Requires time to master. |

| Backtesting capabilities: MT5 enables traders to test automated trading systems and Expert Advisors on historical data to evaluate their viability before risking live capital. | Coding skills needed: Building EAs and custom indicators requires knowledge of the MQL5 programming language which has a learning curve. |

| Copy trading: Traders can use the Signals and Market features to automatically copy trades from other successful traders on the platform. This social trading helps less experienced traders benefit from others. | Potential platform issues: Software crashes or connectivity problems can lead to errors in trading or account management. |

| Advanced indicators: MT5 comes equipped with over 80 in-built technical indicators that can be used for analyzing Forex charts and identifying potential trading opportunities. Custom indicators can also be built. | |

| Multi-asset platform: Although focused on Forex, MT5 also supports trading instruments like stocks, futures and commodities. This provides diverse trading opportunities on one platform. | |

| Mobile trading apps: MT5 has iOS and Android mobile apps so traders can analyze charts, place trades, and manage positions while on the go. |

Overall, the advanced functionality of the MT5 platform gives Forex traders the tools they need for effective market analysis, strategy building, and trade execution.

Top MetaTrader 5 Indicators for Forex Trading

Technical indicators are invaluable tools in a Forex trader’s toolkit. Here are some of the most popular MT5 indicators used for analyzing currency pairs:

Moving Averages

The Moving Average indicator smoothens out price action by taking the average price over a specified time period and plotting it as a line on the chart. The two most common MAs are the 50 and 200-period moving averages. Crossovers between the faster and slower moving averages can signal changes in the momentum and trend direction. Moving averages act as dynamic support and resistance levels. They also help clearly visualize the trend – uptrend if price is above MA and downtrend if price is below MA.

Bollinger Bands

Bollinger Bands overlay two volatility bands above and below a simple moving average line. The bands widen during periods of higher volatility and contract during lower volatility. This gives a relative definition of high and low volatility. Wider bands show increased volatility. Bollinger bands also act as dynamic support and resistance levels. Price touching the upper or lower bands can signal overbought or oversold conditions. The bands also help determine trading ranges.

Relative Strength Index (RSI)

The Relative Strength Index is a momentum oscillator that measures the magnitude and speed of directional price movements between 0 and 100. Traditional overbought and oversold levels are 70 and 30. The RSI staying above 50 signals an uptrend while below 50 signals a downtrend. Divergence between price and RSI can foreshadow trend changes. For example, price making new highs while RSI is falling could mean a reversal. Sharp RSI moves to above 70 or below 30 hint at potential trade entries.

MACD (Moving Average Convergence Divergence)

The MACD plots the relationship between a 26-period and 12-period exponential moving average. Crossovers of the MACD line and signal line indicate trend changes. The MACD histogram visualizes momentum – a positive value means upside momentum while negative means downside momentum. The MACD helps identify subtle shifts in momentum and strength of the trend. Divergence between MACD and price can lead to powerful trades.

Stochastic Oscillator

The Stochastic oscillator analyzes where closing prices are relative to the trading range over a set time period, typically 14 days. The oscillator provides overbought/oversold signals and warns of potential trend endings. It oscillates between 0 and 100. Readings above 80 suggest an overbought situation, while readings below 20 suggest oversold conditions. Divergences between Stochastic and price indicates an imminent reversal.

Ichimoku Cloud

The Ichimoku Cloud Indicator is a technical analysis method used to identify the direction of the trend and key support and resistance levels. It consists of five lines – the tenkan sen, kijun sen, senkou span A, senkou span B, and the chikou span. The area between Senkou Span A and B constitutes the Ichimoku Cloud. A bullish signal occurs when the price closes above the cloud, while a bearish signal occurs when the price closes below the cloud. A flat/sideways market occurs when the price oscillates within the cloud. The thicker the cloud, the stronger the support/resistance. The senkou spans act as dynamic support/resistance levels similar to moving averages. The Chikou Span helps confirm trend direction and momentum.

Using MetaTrader 5 Demo Account for Practice

Before trading live, it is highly recommended that novice traders open a demo account on the MT5 platform to practice trading in a risk-free environment. A demo account provides simulated market conditions using real historical price data. Traders can use the virtual funds to test out strategies before putting actual capital at risk.

Here are some tips for using the MT5 demo account effectively:

- Use demo trading to become familiar with the platform’s features and tools. Practice placing different order types.

- Add indicators and test out trading systems to see if they are profitable over historical periods. This will build confidence in the strategy.

- Execute trades as if using real money. This will help develop discipline and sound risk management principles.

- Keep a trading journal to record strategies, market conditions, emotions etc. Review the journal to improve trading skills.

- Participate in demo contests to compete against other traders using virtual funds and gain motivation.

Don’t worry about losses in demo trading. The virtual funds can be reset. Focus on improving strategy. Overall, extensive practice on a MT5 demo account will help traders refine their skills, strategies and mental ability so they are prepared for live trading. There is no substitute for experience.

Getting Started with MetaTrader 5 for Forex

For traders looking to get started using the MT5 platform for trading Forex, here are some steps to begin:

- Find a regulated broker that offers the MetaTrader 5 platform and provides access to your desired markets. Opening a demo account first is recommended.

- Download and install the MT5 desktop trading platform, mobile apps and/or web platform as required. Sign in with broker account details.

- Spend time getting familiar with the platform’s interface and key features. Customize the appearance as desired.

- Add any technical indicators, Expert Advisors or other tools to be used for market analysis or generating trading signals.

- Use the demo account to practice executing different order types and test trading strategies in a risk-free environment.

- Develop a trading plan detailing aspects like risk management, position sizing, trading frequency and currency pairs to be traded.

- Start live trading small position sizes during the lowest volatility sessions, focusing on the best setups matching your plan.

- Keep reviewing performance to improve skills. The key is to practice trading like a professional, managing risks and emotions.

With its advanced features and active community, MetaTrader 5 provides an efficient ecosystem for both new and experienced Forex traders. Follow proper guidance and put in dedicated practice to succeed.

Frequently Asked Questions

Is MetaTrader 5 free to use?

Yes, MetaTrader 5 is free to download and use. However, you need an account with a broker that supports MT5 to access live market data feeds and trade on the financial markets. Many brokers offer MT5 demo accounts to practice for free.

What is the minimum deposit for a MetaTrader 5 account?

The minimum deposit amount varies between brokers. Most have a minimum deposit requirement ranging from $100 to $500 for a live MT5 account. It is best to start a demo account first with virtual money to practice risk-free.

Does MT5 work on Mac?

Yes, MetaTrader 5 has a native desktop app for Mac OS in addition to Windows and Linux. There are also MT5 apps available for iOS and Android devices for mobile trading.

What is the MQL5 programming language used for?

MQL5 is the programming language used on MetaTrader 5 to create automated trading systems, custom indicators, scripts and other tools. Knowledge of MQL5 helps programmers develop Expert Advisors, signaling tools and other functionality.

Is copy trading available on MT5?

Yes, the MetaTrader 5 platform supports copy trading through its Signals and Market features. Traders can copy trades automatically from other vetted strategy providers, subject to risk management. This allows less experienced traders to benefit from more seasoned traders.