Best Forex Trading Strategies

| Position | Company Logo | Information | Bonuses | Min. Dep | Regulation | Open an account |

|---|---|---|---|---|---|---|

|

|

|

Minimum Deposit: $20 |  |

||

|

|

|

Minimum Deposit: $250 |  |

||

|

|

|

Minimum Deposit: $250 |  |

||

|

4

|

|

|

Minimum Deposit: $250 |  |

||

|

5

|

|

|

Minimum Deposit: $100 |  |

||

|

6

|

|

No deposit bonus | Minimum Deposit: $5 |  |

||

|

7

|

|

|

No deposit bonus | Minimum Deposit: $10 |  |

|

|

8

|

|

|

Minimum Deposit: $250 |  |

||

|

9

|

|

No deposit bonus | Minimum Deposit: $250 |  |

||

|

10

|

|

|

No deposit bonus | Minimum Deposit: $100 |  |

|

|

11

|

|

No deposit bonus | Minimum Deposit: $10 |  |

||

|

12

|

|

|

No deposit bonus | Minimum Deposit: $25 |  |

|

|

13

|

|

|

No deposit bonus | Minimum Deposit: $100 |  |

|

|

14

|

|

No deposit bonus | Minimum Deposit: $10 |  |

||

|

15

|

|

|

No deposit bonus | Minimum Deposit: $10 |  |

|

|

16

|

|

|

No deposit bonus | Minimum Deposit: $2 |  |

|

|

17

|

|

|

No deposit bonus | Minimum Deposit: $500 |  |

Forex trading involves buying and selling currencies in order to profit from interest rates and price movements. Having a well-defined trading strategy is crucial for success as a forex trader. This article will discuss some of the most effective forex trading strategies that traders can use.

What is a Forex Trading Strategy?

A forex trading strategy is a structured approach to trading currencies based on predefined rules and analysis. The strategy sets out when to buy or sell a currency pair, where to place stop losses, targets, and how to manage the trade. A good forex strategy takes into account factors like risk management, the trader’s style, market conditions, and more.

Strategies help traders make quick decisions amidst forex market volatility. They provide a framework for analyzing price movements and identifying trading opportunities with an edge. Without a strategy, traders are left gambling and reacting instinctively to ever-shifting market moves. Implementing an edge with a defined strategy is key to long-term success in forex trading.

Basics of a Trading Strategy

The best forex trading strategies complement the trader’s style and goals. Day traders will opt for short-term strategies, while long-term investors prefer position trading strategies spanning weeks or months. The assets traded also impact the strategy type; strategies for trading the major currency pairs like EUR/USD differ from exotic pairs.

When forming a trading strategy, traders should consider key components like indicators, entry/exit criteria, risk management, position sizing, time frames, and market conditions. The key basics when forming a strategy include:

Indicators

While not set in stone, technical indicators like moving averages, Bollinger Bands, RSI, and others can supplement strategy rules by helping assess momentum, volatility, overbought/oversold levels, and trend direction. However, indicators alone should not dictate trades. Price action context is crucial.

Entry/exit criteria

The entry/exit criteria defines specific rules for opening and closing both long and short trades. For example, entering on a break of resistance or exiting at a profit target level. Clear criteria improve strategy execution.

Risk/reward

This guidelines help traders set stop losses and take profit levels to minimize losses and maximize gains per trade. A 1:2 risk-reward ratio (risking $1 to make $2) is commonly used. With a good risk/reward ratios minimize losses and maximize gains.

Position sizing

Rules to determine how much capital to risk on each trade. Many traders risk only 1-2% of their account per trade to protect capital. For example, if your trading capital is $1000, you can decide to risk $10 per trade, which is 1%. This is a risk management practice to help you preserve your account long term.

Time frames

This refers to the general trade durations like day trading, swing trading, or trend trading over weeks/months. Strategies should align to the chosen time frame.

Market conditions

Finally, market conditions impact strategies. Ranging, trending, low/high volatility environments each suit certain types of strategies. Adapting to changing conditions improves performance. Analyze price action and modify strategies accordingly.

Creating the Best Forex Trading Strategies

Creating an effective forex trading strategy requires following a systematic approach. Here is a step-by-step process for creating the best forex trading strategies:

- Define your goals and trading style: Are you aiming for day trading or long-term trends? High volume or selective trading? Answering these questions will shape your strategy.

- Research trading indicators relevant for your strategy: For a trend trading strategy, useful indicators may include moving averages, MACD and Bollinger Bands. For breakout trading, indicators like average true range and pivot points may be more applicable.

- Establish concrete entry rules: Will you enter on a break of resistance, moving average crossovers, overbought/oversold signals, or other well-defined criteria? Entry rules trigger when to get into trades.

- Develop clear exit rules: When and how will you exit profitable vs unprofitable trades? Exit rules like trailing stops, target prices or volatility-based exits are essential.

- Define risk management parameters: How much to risk per trade? Where to place stops? How to size positions? Stringent risk controls are vital.

- Determine timeframe for trades and strategy effectiveness: Shorter term strategies like scalping and daytrading require hourly or lower timeframes like the 15 minute, 5 minute, and 1 minute. Daily, weekly charts more suited for long-term strategies.

- Backtest and Forward test: Implement backtesting to validate strategy performance in different market conditions over many years of historical data. Tweak inputs to improve results. Forward test your strategy over months in real-time using a practice account. This stage builds experience executing trades in live market conditions.

- Establish a plan for ongoing review and improvement: Evaluate metrics, performance, market adaption and trader discipline regularly to keep optimizing the strategy.

- Implement the strategy in live trading: Start small to build confidence and experience. Closely track trades, performance metrics, and trader psychology.

Following this disciplined process helps develop robust, high-probability and risk-controlled trading strategies tailored to your goals and style as a forex trader.

Examples of Forex Trading Strategies

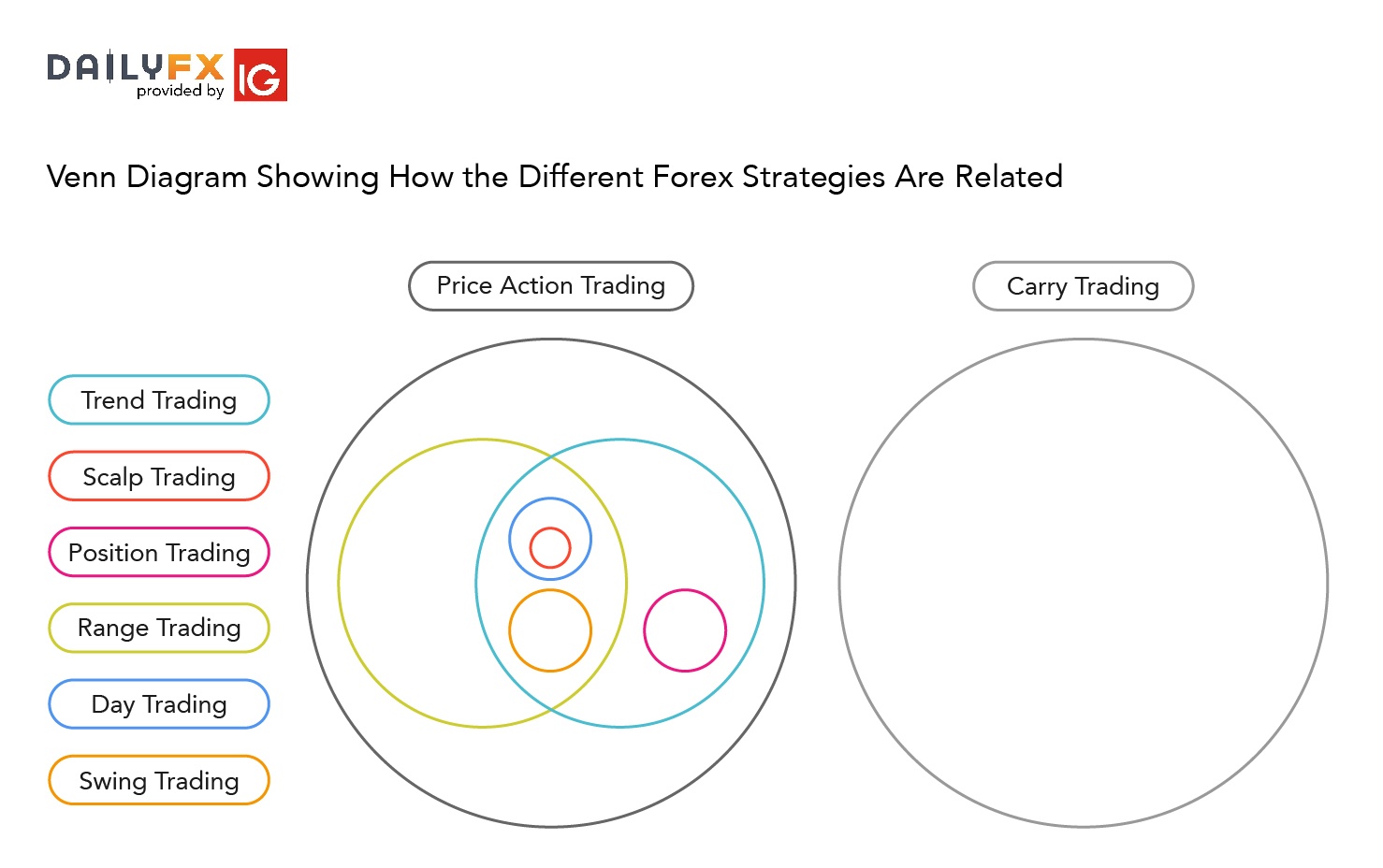

Here are some examples of common forex trading strategy types:

Trend Following

Trend following aims to capitalize on major price trends. Traders use indicators like moving averages to identify the predominant trend on multiple timeframes and trade in that direction. This strategy profits from extended upside or downside momentum in currency pairs. For example, if the 50-day moving average on the EUR/USD daily chart is sloping up, a trader may look to go long at support levels within the upward trend.

Breakout Trading

The breakout strategy looks to enter positions when price breaks out of identified support or resistance levels. Breaking these key levels often leads to swift moves which traders capitalize on. Strict entry rules are set to trade breakouts early. For example, if the EUR/USD breaks above resistance at 1.1200, a trader may buy with a stop below the breakout level.

Retracement/Reversal Trading

These counter-trend strategies look to enter trades when price pulls back after a trend impulse. Pullbacks to moving averages, Fibonacci levels, pivot points, or overbought/oversold readings provide retracement entry signals. For instance, a trader may look to sell a pullback to the 50% Fibonacci retracement level after an uptrend.

News Trading

This strategy revolves around trading major economic news events that spark volatility. Positions are taken just before or after the release based on expected reactions. Fast execution and wide stop-losses manage risk with this volatile strategy. For example, a trader may short a currency if an interest rate cut is announced, anticipating it will decline.

Carry Trade

Carry trading involves selling low interest rate currencies and buying higher yielders to collect the interest differential. Traders look to profit from the difference in rates over the long run. For instance, they may buy the AUD and sell the JPY to benefit from the interest rate spread between those currencies.

Time to Change Strategies

Even some of the best forex trading strategies fail sometimes. It may become necessary to change or adapt trading strategies from time to time. Reasons why traders switch up their strategies include:

- The market environment changes: For example, volatility declines sharply, reducing opportunities for range and swing trading strategies.

- Trader psychology evolves: With experience, a trader’s risk appetite or decision-making style may shift.

- The strategy stops working: If backtesting or actual results show deteriorating performance, it’s time for a change.

- New opportunities emerge: Evolving markets present different kinds of profitable trades not captured in the current strategy.

- Better strategies become available: As traders gain knowledge and skill, they design superior strategies to deploy.

- Risk management needs adjustment: Changes in volatility or account size may necessitate strategy modifications to properly manage risk.

- Trading improves: Switching strategies can lead to more trading success for some traders as they refine their approach.

Tips for Forex Trading Strategies

Here are some additional tips for getting the most out of the best forex trading strategies:

- Find a strategy that fits your personality and trading style. Don’t try to trade a strategy you feel uncomfortable with.

- Keep strategy rules simple for easier implementation. Overly complex systems are difficult to follow.

- Be patient in executing high-probability trades. Rushing into low probability trades is a common mistake.

- Manage your money effectively within the strategy. Appropriate position sizing is key.

- Remain flexible but disciplined in your trading. Rules provide discipline, while flexibility allows for strategy evolution.

- Track all your trades to evaluate performance. Identify issues early so you can adapt.

- Focus on continuous improvement. Even profitable strategies can be made better.

Conclusion

Having a well-defined trading strategy is essential to success in forex markets. Such a strategy provides entry and exit rules, risk parameters, time horizons, and other guidelines. Simple strategies like trend following work well for many traders. Other types include range trading, breakouts, scalping, and swing trading.

Keeping trading plans flexible and reviewing performance periodically allows trading strategies to evolve and improve over time as market conditions and individual skills change. No strategy is 100% accurate. However, with persistent practice, and strong discipline, traders give themselves an advantage in this challenging but rewarding field.

Frequently Asked Questions

Can you be profitable without a trading strategy?

Trading forex profitably over the long run is very difficult without a defined strategy. A trading plan helps manage risk, identify favorable trades, and remove emotion-driven decisions that may be unprofitable.

How do I choose the right forex trading strategy?

Consider your trading goals, available time to trade, preferred timeframes, and risk appetite. Test out strategies that fit your style. The right one provides an edge while being easy to follow.

What is the best way to test a trading strategy before putting real money at risk?

The best way is to thoroughly backtest the strategy by applying it to historical price data. This provides performance metrics like risk-reward ratios, win rates, drawdowns, etc. It’s also critical to demo trade in real-time before going live.

How often should trading strategies be reviewed and updated?

Strategies should be reviewed regularly, such as every few months or at least a couple times a year. This periodic review helps determine if any adjustments are needed to optimize performance. Key metrics and current market conditions should be analyzed.

Can simple trading strategies be profitable?

Absolutely. Some of the best strategies are quite simple. Too much complexity can actually degrade performance and make a strategy more difficult to execute consistently. If the core elements – like risk management, probability, and favorable risk/reward – are sound, a simple approach can work very well.