Binary Options Keltner Channel Trading Strategy

| Position | Company Logo | Information | Bonuses | Min. Dep | Regulation | Open an account |

|---|---|---|---|---|---|---|

|

|

|

Minimum Deposit: $20 |  |

||

|

|

|

Minimum Deposit: $250 |  |

||

|

|

|

Minimum Deposit: $250 |  |

||

|

4

|

|

|

Minimum Deposit: $250 |  |

||

|

5

|

|

|

Minimum Deposit: $100 |  |

||

|

6

|

|

No deposit bonus | Minimum Deposit: $5 |  |

||

|

7

|

|

|

No deposit bonus | Minimum Deposit: $10 |  |

|

|

8

|

|

|

Minimum Deposit: $250 |  |

||

|

9

|

|

No deposit bonus | Minimum Deposit: $250 |  |

||

|

10

|

|

|

No deposit bonus | Minimum Deposit: $100 |  |

|

|

11

|

|

No deposit bonus | Minimum Deposit: $10 |  |

||

|

12

|

|

|

No deposit bonus | Minimum Deposit: $25 |  |

|

|

13

|

|

|

No deposit bonus | Minimum Deposit: $100 |  |

|

|

14

|

|

No deposit bonus | Minimum Deposit: $10 |  |

||

|

15

|

|

|

No deposit bonus | Minimum Deposit: $10 |  |

|

|

16

|

|

|

No deposit bonus | Minimum Deposit: $2 |  |

|

|

17

|

|

|

No deposit bonus | Minimum Deposit: $500 |  |

Are you new to binary options trading? If so, you’ve likely heard about the potential rewards and risks associated with this fast-paced trading environment. One of the most popular and effective strategies for navigating the binary options market is the Keltner Channel trading strategy. In this comprehensive guide, we’ll break down this powerful approach, equipping you with the knowledge and tools you need to make informed trading decisions.

Understanding the Keltner Channel Indicator

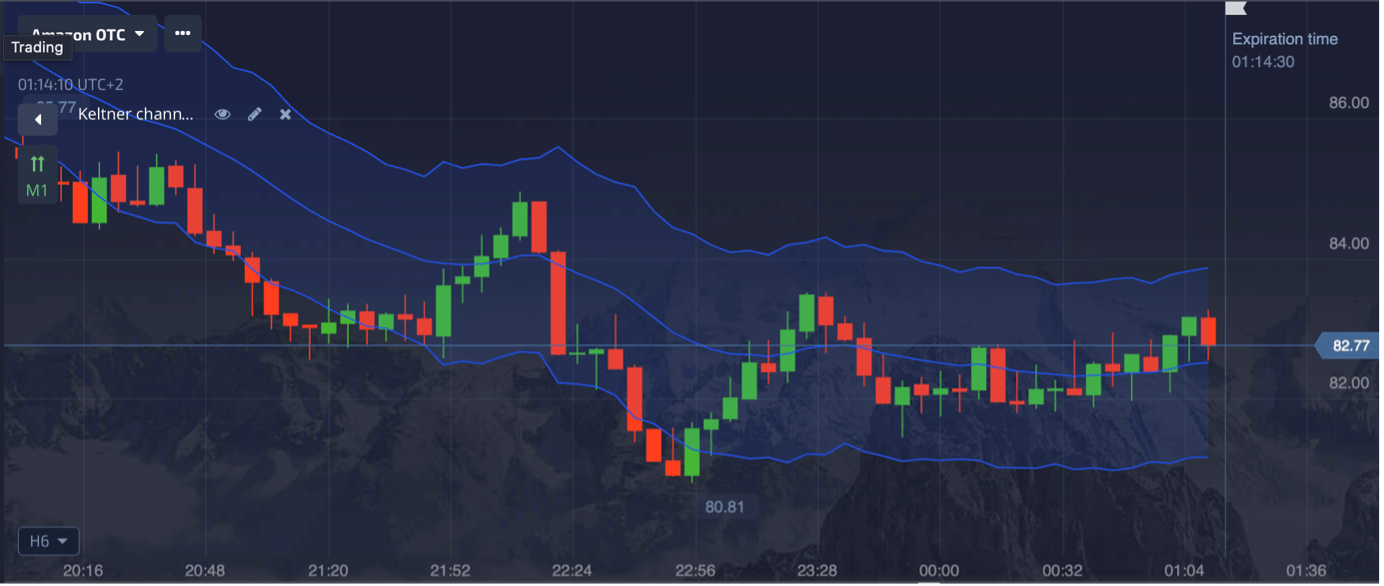

The Keltner Channel trading strategy relies on the Keltner Channel indicator. The Keltner Channel is a volatility-based indicator that plots trading channels consisting of an upper and lower band around an asset’s price.

These bands are calculated using the Average True Range (ATR) indicator, which measures the asset’s volatility by considering the entire trading range, including gaps. The Keltner Channel then incorporates the Exponential Moving Average (EMA) to smooth out price fluctuations and provide a more accurate representation of the asset’s trend.

The upper and lower bands of the Keltner Channel are plotted at a specific multiple of the ATR above and below the EMA, respectively. This multiple, known as the channel multiplier, is typically set to a value between 1 and 3, with higher values indicating wider bands and lower values indicating narrower bands.

When the price breaks above the upper Keltner Channel band, it may indicate increased bullish momentum and signal a potential buying opportunity. Conversely, when the price breaks below the lower Keltner Channel band, it may suggest increased bearish momentum and a potential selling opportunity. Moreover, the slope of the Keltner Channel itself can provide information about the overall trend direction. An upward sloping channel suggests an uptrend, while a downward sloping channel indicates a downtrend.

The Binary Options Keltner Channel Trading Strategy

Now that you understand the underlying principles of the Keltner Channel indicator, let’s delve into the specifics of the Binary Options Keltner Channel trading strategy.

The key principles of this strategy revolve around identifying potential buy and sell signals based on the price’s relationship with the Keltner Channel bands. Here’s how it works:

Buy Signal (Call Option)

When the price breaks above the upper Keltner Channel band, it may indicate increased bullish momentum and signal a potential buying opportunity. Traders can consider placing a call option (buy) trade, anticipating that the asset’s price will continue to rise.

Example: Suppose you’re trading a binary option on the EUR/USD currency pair, and you notice that the price has broken through the upper Keltner Channel band. This could be an indication of strong bullish momentum, prompting you to place a call option trade with the expectation that the EUR/USD rate will continue to increase.

Sell Signal (Put Option)

Conversely, when the price breaks below the lower Keltner Channel band, it may suggest increased bearish momentum and signal a potential selling opportunity. In this case, traders can consider placing a put option (sell) trade, anticipating that the asset’s price will continue to decline.

Example: Let’s say you’re trading a binary option on Apple’s stock, and you observe that the price has breached the lower Keltner Channel band. This could be an indication of strong bearish momentum, prompting you to place a put option trade with the expectation that Apple’s stock price will continue to fall.

Channel Direction

In addition to the buy and sell signals, the slope of the Keltner Channel itself can provide valuable insights into the overall trend direction. An upward sloping channel suggests an uptrend, while a downward sloping channel indicates a downtrend. Aligning your trades with the prevailing trend can increase the likelihood of success.

Example: If you’re trading a binary option on gold, and you notice that the Keltner Channel is sloping upwards, it could be a sign of an ongoing uptrend in the precious metal market. In this case, you may want to prioritize call option trades to capitalize on the bullish momentum.

Confirmation

While the Keltner Channel can provide strong signals, it’s often beneficial to seek additional confirmation from other technical indicators or chart patterns. This can help increase the reliability of your trade signals and minimize the risk of false breakouts.

Common confirming indicators used in conjunction with the Keltner Channel include moving averages (e.g., simple moving average, exponential moving average), oscillators (e.g., Relative Strength Index, Stochastic Oscillator), and candlestick patterns (e.g., engulfing patterns, doji candlesticks).

Example: Suppose you’re trading a binary option on the S&P 500 index, and you notice that the price has broken above the upper Keltner Channel band. However, before placing a call option trade, you decide to seek confirmation from the Relative Strength Index (RSI) indicator. If the RSI is also showing overbought conditions (above 70), it could strengthen the bullish signal and increase your confidence in the trade.

Risk Management and Trade Setup

While the Binary Options Keltner Channel trading strategy can be a powerful tool, it’s crucial to incorporate proper risk management practices to ensure long-term success in binary options trading. Here are some important considerations for managing risk and setting up trades:

Stop-Loss and Take-Profit Levels

Establishing stop-loss and take-profit levels is essential for managing risk and locking in profits. A stop-loss order is designed to automatically close a trade if the market moves against you, limiting potential losses. Conversely, a take-profit order is used to automatically close a trade once a predetermined profit target has been reached. By setting these levels, you can effectively control your risk exposure and protect your trading capital. It’s generally recommended to set stop-loss levels based on your risk tolerance and the volatility of the underlying asset.

Position Sizing and Money Management

Proper position sizing and money management are critical components of any successful trading strategy. Position sizing refers to the amount of capital you allocate to each trade, while money management involves managing your overall trading capital effectively. A common rule of thumb is to risk no more than 1-2% of your trading capital on any single trade. This approach helps mitigate the impact of potential losses and ensures that you have sufficient capital to continue trading even after a series of unsuccessful trades.

Risk-Reward Ratio

When setting up trades, it’s essential to consider the potential risk-reward ratio. The risk-reward ratio is calculated by dividing the potential profit by the potential loss for a given trade. Generally, traders aim for a risk-reward ratio of at least 1:2 or higher, meaning that the potential profit should be at least twice the potential loss. By maintaining a favorable risk-reward ratio, you can increase the likelihood of long-term profitability, even if not every trade is successful.

Diversification

Diversification is another crucial aspect of risk management in binary options trading. Rather than putting all your capital into a single trade or asset, consider diversifying your portfolio by trading multiple assets or markets. This can help mitigate the impact of potential losses and reduce overall risk exposure.

Advantages and Disadvantages

Like any trading strategy, the Binary Options Keltner Channel trading strategy has its own set of advantages and disadvantages. Understanding these can help you make more informed decisions and manage your expectations effectively.

| Advantages | Disadvantages |

| Clear Entry and Exit Signals: One of the primary advantages of this strategy is the clear visual cues it provides for potential entry and exit points. The Keltner Channel bands act as defined levels for identifying buy and sell signals, offering traders a straightforward approach to spotting trading opportunities. | False Signals: While the Keltner Channel can provide strong signals, there is always the possibility of false breakouts or whipsaws, where the price briefly breaks through a band but then reverses direction. This can lead to potential losses if trades are executed based solely on the Keltner Channel signals. |

| Incorporates Volatility: By incorporating the Average True Range (ATR) in its calculations, the Keltner Channel accounts for market volatility, providing a more accurate representation of potential price movements. This can be particularly useful in volatile markets where traditional indicators may struggle to keep up. | Lagging Indicator: As with many technical indicators, the Keltner Channel is a lagging indicator, meaning it reacts to past price movements rather than predicting future ones. This can result in traders entering trades late or missing potential opportunities. |

| Trend Identification: The slope of the Keltner Channel can help traders identify the overall trend direction, allowing them to align their trades with the prevailing market sentiment and potentially increasing their chances of success. | Reliance on Confirmation: While the Keltner Channel can be a powerful tool, it is often recommended to seek additional confirmation from other technical indicators or chart patterns. This can add complexity to the trading process and require a more advanced understanding of technical analysis. |

| Versatility: The Keltner Channel strategy can be applied to a wide range of assets, including currencies, stocks, commodities, and indices, making it a versatile tool for traders with diverse portfolios. |

Backtesting and Optimization

Before implementing the Binary Options Keltner Channel trading strategy in a live trading environment, it’s essential to backtest and optimize the strategy parameters using historical data. Backtesting allows you to evaluate the performance of the strategy over different market conditions and time periods, providing valuable insights into its potential effectiveness.

Platforms like IQCent, Videforex, Raceoption, Smartytrade, and Binarycent offer backtesting capabilities, enabling you to test the strategy with different settings and parameters. This can include adjusting the Keltner Channel multiplier, the length of the Exponential Moving Average (EMA), or the parameters of any additional confirming indicators you plan to use.

During the backtesting process, it’s crucial to analyze various performance metrics, such as win rate, average profit/loss, maximum drawdown, and overall profitability. This information can help you identify the optimal settings for the strategy and make necessary adjustments before deploying it in live trading.

Additionally, backtesting can reveal potential limitations or weaknesses of the strategy, allowing you to develop risk management strategies or consider complementary approaches to mitigate these shortcomings.

Conclusion

Binary Options Keltner Channel Strategy is a structured approach to binary options trading. Traders can use the Keltner Channel indicator, confirming signals, and risk management to identify profitable opportunities and manage risk. Success in binary options trading requires discipline, patience, and continuous learning and adaptation. Backtest and optimize your strategy, stay updated with market conditions and news to maximize success.