Binary Options Trading Robots

| Position | Company Logo | Information | Bonuses | Min. Dep | Regulation | Open an account |

|---|---|---|---|---|---|---|

|

|

|

Minimum Deposit: $20 |  |

||

|

|

|

Minimum Deposit: $250 |  |

||

|

|

|

Minimum Deposit: $250 |  |

||

|

4

|

|

|

Minimum Deposit: $250 |  |

||

|

5

|

|

|

Minimum Deposit: $100 |  |

||

|

6

|

|

No deposit bonus | Minimum Deposit: $5 |  |

||

|

7

|

|

|

No deposit bonus | Minimum Deposit: $10 |  |

|

|

8

|

|

|

Minimum Deposit: $250 |  |

||

|

9

|

|

No deposit bonus | Minimum Deposit: $250 |  |

||

|

10

|

|

|

No deposit bonus | Minimum Deposit: $100 |  |

|

|

11

|

|

No deposit bonus | Minimum Deposit: $10 |  |

||

|

12

|

|

|

No deposit bonus | Minimum Deposit: $25 |  |

|

|

13

|

|

|

No deposit bonus | Minimum Deposit: $100 |  |

|

|

14

|

|

No deposit bonus | Minimum Deposit: $10 |  |

||

|

15

|

|

|

No deposit bonus | Minimum Deposit: $10 |  |

|

|

16

|

|

|

No deposit bonus | Minimum Deposit: $2 |  |

|

|

17

|

|

|

No deposit bonus | Minimum Deposit: $500 |  |

An option trading robot is an automated software program that trades options contracts on behalf of users. These robots utilize algorithms and trading signals to determine when to enter and exit trades. Options trading robots have become increasingly popular among retail traders looking to automate their trading strategies. This article will discuss what an options trading robot is, how to choose one, the pros and cons of using them, and other key information.

What is an Options trading Robot?

An options trading robot is pre-programmed software that analyzes market data and initiates trades automatically based on predetermined parameters and trading logic. The robot’s software makes trading decisions and executes trades on behalf of the user.

Options robots utilize technical indicators, chart patterns, statistics, and other analytical data to identify profitable trading opportunities. The algorithms and logic encoded in the software then determine entry and exit points for trades. This automated approach takes human emotional bias out of trading and allows for objective, data-driven trade execution.

Once set up, the options robot can automatically manage trades, place orders, generate signals, and monitor markets around-the-clock. This allows traders to automate their option strategies without having to sit in front of a computer all day. The user maintains control over customizing settings like assets traded, position sizing, risk management, and more.

How Options Trading Robots Work

Options trading robots utilize complex algorithms to analyze market data and identify trading opportunities. Here is an overview of how robots work:

- Analyze Technical Indicators: Robots scan price charts and analyze technical indicators like moving averages, Bollinger bands, RSI, and more to identify trends and momentum.

- Evaluate Statistics: Historical stats, volatility data, trading volume, and other metrics are evaluated to determine the probability of profitable trades.

- Generate Trading Signals: When opportunities arise based on analysis, the robot’s logic triggers buy, sell, or hold signals.

- Initiate and Manage Trades: The robot automatically executes the trades according to position sizing and risk parameters set by the user. It can also facilitate exiting trades at profit targets and stop losses.

- Optimization & Machine Learning: Many robots utilize machine learning and AI to continually optimize strategies based on performance and evolving market conditions.

Overall, options trading robots leverage the processing power of computers and complex algorithms to automate the analysis and execution of trades based on technical and statistical factors. This eliminates the biases and limitations of manual trading.

Options Trading Robot Costs

There are a few common pricing models for options trading robot services:

- Subscription Model: Traders pay a monthly fee for access to the robot, typically ranging from $50 to $300 per month.

- Commission-Based: The robot service charges a per-trade commission, such as $1 to $5 per contract traded. Higher-volume traders pay more.

- One-Time License: Traders make a single upfront payment, from a few hundred to a few thousand dollars, to buy a lifetime license for the robot software.

- Free Robots: Some brokers provide free options trading robots to platform users. The broker profits from commissions generated by the robot’s trading activity.

Besides these costs, traders must account for option contract fees, exchange fees, commissions to brokers, and slippage on trades. It’s important to factor in all these expenses when evaluating the potential profitability of an options trading robot.

Choosing an Options Trading Robot

With a wide variety of options robots available, traders should evaluate the following factors when choosing one:

- Performance History: Look for verified, audited performance reports to analyze the robot’s win rate, risk metrics, and profitability. Beware of promises of unrealistic returns.

- Trading Strategy: Understand the logic, indicators, and parameters behind the robot’s trading strategy so you can evaluate its effectiveness.

- Customization Options: The ability to customize settings for assets, trade amounts, risk management, and automation level is important.

- Ease of Use: The robot should have an intuitive interface and setup process for configuring strategies, viewing metrics, and monitoring positions. Accessible customer support is vital.

- Costs: Options robots have monthly subscription fees, one-time licensing costs, or commission-based charges. Compare pricing models before selecting one.

- Regulation: It’s preferable to choose an SEC-registered options trading robot for security of funds and data integrity.

- Compatibility: Check that the robot seamlessly integrates with your brokerage account and trading platform.

Analyzing these key factors will help traders select the top-performing options trading robot that best fits their trading requirements.

Pros and Cons of Options Trading Robots

Utilizing an options trading robot offers traders several potential benefits. But despite their benefits, options trading robots also come with some pitfalls for traders. Here are the pros and cons to understand:

| Pros | Cons |

| Emotionless Execution: Robots make objective trading decisions unaffected by fear, greed, or other biases that can lead to poor human judgment. | Over-optimization: Robots may be over-optimized for past market conditions and fail when those conditions change in the future. |

| 24/7 Automation: Algorithms enable constant monitoring of markets and automated execution of trades, even when you are away from your computer. | Technical Issues: Software crashes, connectivity problems, power losses and other glitches can halt automated trading and lead to losses. |

| Faster Reaction Times: Robots can scan for trading opportunities and execute orders in milliseconds, far faster than humans. | False Sense of Security: Over-reliance on robots can lead to complacency in monitoring positions and managing risk. |

| Improved Risk Management: Pre-programmed risk parameters like stop losses and position sizing limit losses on unprofitable trades. | Potential Over-trading: Overly aggressive robots can over-trade and rack up excessive transaction fees. |

| Diversification: Robots can monitor and trade a diverse array of options contracts across various expiration dates, strikes, and underlying assets. | |

| Potentially Higher Returns: By automating disciplined strategies optimized for current market conditions, traders may improve trade performance. |

What is the Best Options Trading Robots?

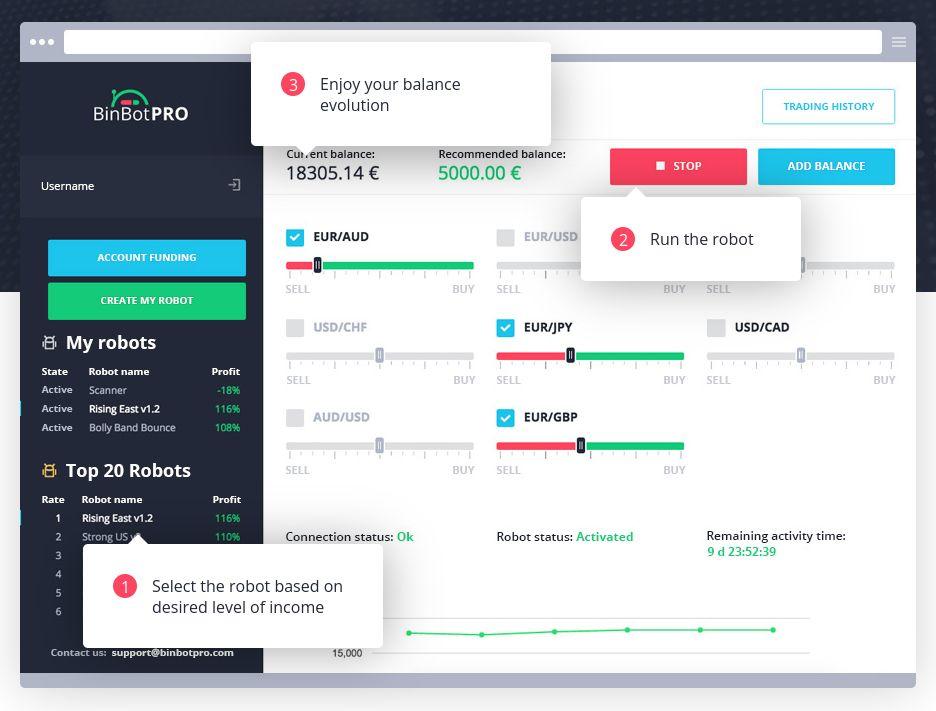

When it comes to Options trading bots, Binbot pro is a reliable choice for most traders. Binbot Pro is an automated options trading robot that utilizes powerful algorithms and integrations with top brokers to scan markets, identify opportunities, and execute options trades automatically.

With Binbot Pro, no coding knowledge or manual analysis is required by users. The bot handles the heavy lifting of options trading strategies with its artificial intelligence and machine learning capabilities.

Getting Started with Binbot Pro

Binbot Pro aims to make it simple for beginners to get started with automated options trading. Here are the steps:

- Pass Free Registration: Users can sign up for Binbot Pro for free and access their proprietary algorithms. No license fees or subscriptions are required.

- Activate a Trading Account: Binbot Pro is integrated with leading options brokers like IQCent, Raceoption, BinaryCent, and Videforex. Users fund a trading account with one of these brokers with an initial deposit, typically $250 minimum.

- Let the Bot Trade: Once connected to a funded broker account, Binbot Pro will automatically execute options trades for you based on its strategies and settings. Users can customize assets traded and risk management parameters.

Once properly configured, Binbot Pro claims it can potentially double or triple a user’s account balance through its algorithmic options trading. The bots trade automatically without requiring the user to monitor markets or identify options and opportunities themselves.

Key Features and Benefits

Here are some of the advertised benefits of using Binbot Pro for automated options trading:

- Requires no manual analysis or coding experience

- Proprietary algorithms optimized for trading options

- Integrated with reputable and trusted brokers

- Allows customization of traded assets and risk settings

- Automatic hands-free trading 24/7

- Potential to substantially grow account balances

- Responsive customer service team for support

Tips for Success When Using Options Trading Robots

To maximize your chances of success with options trading robots, keep these tips in mind:

- Thoroughly backtest the robot strategy on historical data before going live. Look for consistency and risk management.

- Start with small position sizes and incrementally increase as the robot proves to be profitable over time.

- Closely monitor the live trades and performance metrics of the robot on a daily basis as market dynamics shift.

- Use tight stop losses on all positions to quickly exit losing trades before major damage is done.

- Be prepared to halt trading and tweak settings if the robot underperforms. Don’t stick with a losing strategy for too long.

- Choose a robot from an established, transparent provider with strong customer service and support resources.

- Be realistic in your profit expectations. Market volatility makes consistent trading gains a challenge, even for robots.

- Focus on long-term performance results rather than short-term wins or losses when evaluating a robot’s strategy.

- Use options robots as one component of a diversified trading approach, not the only strategy you rely on.

Conclusion

Options trading robots utilize powerful algorithms and computing technology to automate analyzing markets, identifying opportunities, entering, and managing trades. Allowing the emotionless execution of strategies 24/7, options robots offer both advantages and disadvantages to traders.

Performing due diligence in researching providers, scrutinizing performance, and customizing risk parameters is vital for giving options robots the highest probability of trading success. Used prudently, options trading robots can enhance portfolio diversification, risk management, and potential profits.

FAQs

Are options trading robots profitable?

Some robots are profitable over time if they employ sound strategies, effective risk management, and optimization for current market dynamics. However, no robot consistently generates profits. Monitoring performance and being prepared to halt trading if losses mount is important.

Can beginners use options trading robots successfully?

Beginners may struggle to understand and effectively customize trading robots initially. Starting with a simple robot, paper trading, and using tiny position sizes can allow beginners to use robots successfully, provided risk is managed.

What happens if my option robot stops working properly?

You can halt automated trading and revert to manual control if your options robot malfunctions. Troubleshoot any issues, adjust settings if needed, contact customer support, and carefully trade before allowing automated trading again.

Is there a way to tell if an options robot is a scam?

Warning signs of options Robot scams include promises of guaranteed returns, a lack of detailed performance reports, no trial period, shallow customer support, and the avoidance of questions about their strategy or coding.