Commodity Trading for Beginners

| Position | Company Logo | Information | Bonuses | Min. Dep | Regulation | Open an account |

|---|---|---|---|---|---|---|

|

|

|

Minimum Deposit: $20 |  |

||

|

|

|

Minimum Deposit: $250 |  |

||

|

|

|

Minimum Deposit: $250 |  |

||

|

4

|

|

|

Minimum Deposit: $250 |  |

||

|

5

|

|

|

Minimum Deposit: $100 |  |

||

|

6

|

|

No deposit bonus | Minimum Deposit: $5 |  |

||

|

7

|

|

|

No deposit bonus | Minimum Deposit: $10 |  |

|

|

8

|

|

|

Minimum Deposit: $250 |  |

||

|

9

|

|

No deposit bonus | Minimum Deposit: $250 |  |

||

|

10

|

|

|

No deposit bonus | Minimum Deposit: $100 |  |

|

|

11

|

|

No deposit bonus | Minimum Deposit: $10 |  |

||

|

12

|

|

|

No deposit bonus | Minimum Deposit: $25 |  |

|

|

13

|

|

|

No deposit bonus | Minimum Deposit: $100 |  |

|

|

14

|

|

No deposit bonus | Minimum Deposit: $10 |  |

||

|

15

|

|

|

No deposit bonus | Minimum Deposit: $10 |  |

|

|

16

|

|

|

No deposit bonus | Minimum Deposit: $2 |  |

|

|

17

|

|

|

No deposit bonus | Minimum Deposit: $500 |  |

Commodity trading has been around for centuries, but it can seem intimidating for beginners. This comprehensive guide aims to demystify commodity trading and provide a solid foundation for those looking to venture into this exciting market. From understanding the basics of how commodity trading works to exploring different market types, trading strategies, and risk management techniques, this article covers all the essential aspects a beginner needs to know.

How it Works

Commodity trading for beginners involves buying and selling raw materials or agricultural products through contracts on exchanges. The most commonly traded commodities are energy (crude oil, natural gas), precious metals (gold, silver), and agricultural products (wheat, corn, soybeans).

Instead of trading the physical goods, traders use futures contracts (agreements to buy/sell at a predetermined price on a future date) or options contracts (rights to buy/sell at a specific strike price within a timeframe).

Commodity prices fluctuate based on supply/demand, economic conditions, weather, geopolitical events, and production levels. Traders aim to profit from these price movements by buying low and selling high using futures or options contracts.

Types of Markets

There are several types of commodity markets where trading takes place:

- Spot Markets: These are physical markets where commodities are bought and sold for immediate delivery.

- Futures Markets: These are derivative markets where futures contracts are traded for the delivery of commodities at a specified future date.

- Options Markets: These are derivative markets where options contracts are traded, giving the holder the right, but not the obligation, to buy or sell a commodity at a predetermined price within a specified timeframe.

- Over-the-Counter (OTC) Markets: These are decentralized markets where commodities are traded directly between two parties, without the involvement of an exchange.

Using Commodity Markets

Commodity markets serve various purposes for different market participants:

- Hedging: Producers and consumers of commodities use futures and options contracts to hedge against price fluctuations and manage their risk exposure.

- Speculation: Traders and investors speculate on commodity price movements, aiming to profit from rising or falling prices.

- Diversification: Investors diversify their portfolios by including commodities, as they tend to have a low correlation with other asset classes like stocks and bonds.

- Price Discovery: Commodity markets facilitate the process of determining fair prices for commodities based on supply and demand factors.

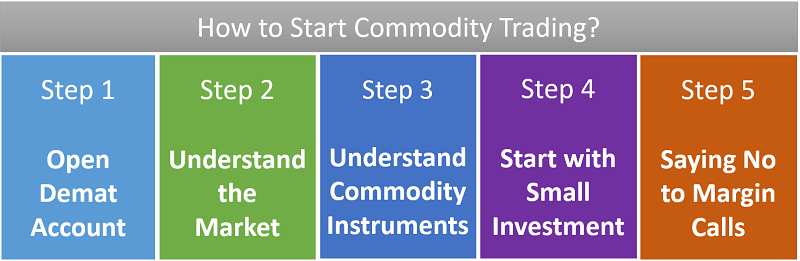

How to Start Trading Commodities

To start trading commodities, you’ll need to open a trading account with a brokerage firm that offers commodity trading services. Some popular brokers for commodity trading include IQCent, Videforex, Smartytrade, Raceoption, and Binarycent. These brokers offer various trading platforms and tools for commodity trading, including CFDs (Contracts for Difference) and binary options.

Once you have a trading account, you can start researching and analyzing commodity markets, developing trading strategies, and executing trades using the broker’s trading platform. It’s essential to start with a demo account to practice and gain experience before risking real money.

Commodity Terminology

Here are some common terms you should familiarize yourself with in commodity trading:

- Futures Contract: An agreement to buy or sell a specific quantity of a commodity at a predetermined price on a future date.

- Options Contract: A contract that gives the holder the right, but not the obligation, to buy or sell a commodity at a specific price (strike price) within a certain timeframe.

- Spot Price: The current market price of a commodity for immediate delivery.

- Margin: A deposit required to open and maintain a position in a futures or options contract.

- Leverage: The ability to control a large position with a relatively small amount of invested capital.

- Hedging: Taking an offsetting position to reduce the risk of adverse price movements.

- Speculation: Taking a position in the market with the primary goal of profiting from price movements.

- Contango: A situation where the futures price of a commodity is higher than the expected spot price at the contract’s expiry.

- Backwardation: A situation where the futures price of a commodity is lower than the expected spot price at the contract’s expiry.

- Basis: The difference between the spot price and the futures price of a commodity.

Basic Commodity Trading Strategies

Here are some basic commodity trading strategies that beginners can consider:

1. Trend Trading

Trend trading involves identifying the overall direction (upward or downward) of commodity prices and taking positions in line with that trend. The idea is to buy when the trend is up (go long) and sell when the trend is down (go short). Beginners can use technical analysis tools like moving averages, trendlines, and momentum indicators to spot trends and determine entry and exit points. For example, if the 50-day moving average is above the 200-day moving average, it could signal an uptrend, and traders may consider buying the commodity.

2. Mean Reversion

This strategy is based on the assumption that commodity prices will eventually revert to their historical mean or average price over time. Traders using this strategy will buy when prices are relatively low and sell when prices are relatively high, with the expectation that prices will move back towards the mean. To implement this strategy, beginners can calculate the historical average price of a commodity over a specific time period and use technical indicators like Bollinger Bands or the Relative Strength Index (RSI) to identify potential entry and exit points when prices deviate significantly from the mean.

3. Spread Trading

Spread trading involves taking offsetting positions in two related commodity markets or contracts to profit from the difference in prices between them. For example, a trader might simultaneously buy a nearby futures contract and sell a longer-dated futures contract for the same commodity, aiming to capture the spread between the two prices. Beginners can use historical data to identify consistent price differences between contract months or related commodities and implement this strategy when the spread widens or narrows beyond its typical range.

4. Seasonal Trading

This strategy involves taking positions based on historical price patterns or seasonal demand factors for certain commodities. For instance, natural gas prices tend to rise in the winter due to higher demand for heating, while agricultural commodity prices may fluctuate based on planting and harvesting seasons. Beginners can analyze historical price data to identify recurring seasonal patterns and plan their trades accordingly, taking long or short positions in anticipation of seasonal price movements.

5. Fundamental Analysis

Fundamental analysis involves evaluating supply and demand factors, economic indicators, and other fundamental data that can impact commodity prices. Beginners can analyze factors such as production levels, inventory levels, weather patterns, geopolitical events, and global economic conditions to gauge the potential impact on commodity prices. For example, if there is a disruption in oil production due to political unrest in a major oil-producing region, traders may anticipate an increase in oil prices and take appropriate positions.

6. Technical Analysis

Technical analysis involves the study of historical price and volume data to identify patterns, trends, and potential entry and exit points for trades. Beginners can use various technical indicators and chart patterns, such as support and resistance levels, moving averages, oscillators (e.g., RSI, Stochastic), and candlestick patterns, to make trading decisions. For instance, if the price of a commodity breaks above a significant resistance level, it could signal a potential uptrend, and traders may consider buying the commodity.

Charts Used in Commodity Trading

Commodity traders heavily rely on charts to analyze price movements, identify patterns, and make informed trading decisions. Here are some commonly used charts in commodity trading:

- Line Charts: These display the closing prices of a commodity over time, making it easy to identify trends and support/resistance levels.

- Bar Charts: These show the open, high, low, and close prices for a specific time period, providing more detailed price information than line charts.

- Candlestick Charts: These use candlestick formations to display the open, high, low, and close prices, as well as the price range for a specific time period. They can help identify potential reversal patterns.

- Point and Figure Charts: These charts filter out small price movements and focus on significant price changes, making them useful for identifying long-term trends.

Pros and Cons of Commodity Trading

Like any investment or trading activity, commodity trading has its advantages and disadvantages. Here’s a table summarizing the pros and cons:

| Pros | Cons |

| Diversification: Commodities can provide diversification benefits to a portfolio. | Volatility: Commodity markets can be highly volatile, leading to significant price fluctuations and potential losses. |

| Hedging Opportunities: Commodity trading allows producers and consumers to hedge against price risks. | Leverage Risk: The use of leverage in commodity trading can amplify both profits and losses. |

| Inflation Hedge: Some commodities, like precious metals, can act as a hedge against inflation. | Complex Markets: Commodity markets can be complex, with various factors influencing supply and demand dynamics. |

| Portfolio Returns: Commodities can potentially enhance portfolio returns over the long term. | Liquidity Risks: Some commodity markets may experience liquidity issues, making it difficult to enter or exit positions. |

| Global Market: The commodity market is a global market, offering opportunities for traders worldwide. | Regulatory Risks: Commodity markets are subject to various regulations, which can change over time and impact trading activities. |

Conclusion

Commodity trading for beginners can be an exciting and potentially profitable venture, but it requires a solid understanding of the markets, risk management strategies, and a willingness to continuously learn and adapt. By starting with a demo account, practicing with different trading strategies, and gradually gaining experience, beginners can navigate the world of commodity trading more confidently.

FAQs

What is the difference between a futures contract and an options contract in commodity trading?

A futures contract is an agreement to buy or sell a specific quantity of a commodity at a predetermined price on a future date, while an options contract gives the holder the right, but not the obligation, to buy or sell a commodity at a specific price (strike price) within a certain timeframe.

How do I choose a suitable commodity trading broker?

When choosing a commodity trading broker, consider factors such as regulation, trading platforms and tools, commission rates, educational resources, customer support, and the availability of commodities you want to trade.

Can I trade commodities with a small account balance?

Yes, it is possible to trade commodities with a small account balance, especially with the use of leverage. However, it’s important to understand the risks associated with leverage and practice proper risk management strategies.

What are the most commonly traded commodities?

Some of the most commonly traded commodities include crude oil, natural gas, gold, silver, copper, wheat, corn, soybeans, and coffee.

How can I manage risk in commodity trading?

Risk management strategies in commodity trading include setting stop-loss orders, using proper position sizing, diversifying your portfolio, and practicing sound money management principles. It’s also essential to continuously educate yourself and stay up-to-date with market developments.