Forex Day Trading Strategies

| Position | Company Logo | Information | Bonuses | Min. Dep | Regulation | Open an account |

|---|---|---|---|---|---|---|

|

|

|

Minimum Deposit: $20 |  |

||

|

|

|

Minimum Deposit: $250 |  |

||

|

|

|

Minimum Deposit: $250 |  |

||

|

4

|

|

|

Minimum Deposit: $250 |  |

||

|

5

|

|

|

Minimum Deposit: $100 |  |

||

|

6

|

|

No deposit bonus | Minimum Deposit: $5 |  |

||

|

7

|

|

|

No deposit bonus | Minimum Deposit: $10 |  |

|

|

8

|

|

|

Minimum Deposit: $250 |  |

||

|

9

|

|

No deposit bonus | Minimum Deposit: $250 |  |

||

|

10

|

|

|

No deposit bonus | Minimum Deposit: $100 |  |

|

|

11

|

|

No deposit bonus | Minimum Deposit: $10 |  |

||

|

12

|

|

|

No deposit bonus | Minimum Deposit: $25 |  |

|

|

13

|

|

|

No deposit bonus | Minimum Deposit: $100 |  |

|

|

14

|

|

No deposit bonus | Minimum Deposit: $10 |  |

||

|

15

|

|

|

No deposit bonus | Minimum Deposit: $10 |  |

|

|

16

|

|

|

No deposit bonus | Minimum Deposit: $2 |  |

|

|

17

|

|

|

No deposit bonus | Minimum Deposit: $500 |  |

Forex day trading opens up an opportunity for gainful profits, but coupled with it are so many risks involved in it. Being a day trader in the forex market is very challenging and to succeed in it, an understanding of successful day trading strategies is necessary. In the course of this wide-ranging guide, you will be provided with all the necessary knowledge and instruments aimed at helping you day trade in the continually changing forex market.

What is Forex Trading All About?

The foreign exchange (forex) market is the largest and most active financial market, with trading volume exceeding $6 trillion just on a daily basis. In contrast to other financial markets, the forex market operates nonstop, operating for 24 hours a day from Monday to Friday, supplying sufficient chances for traders to benefit from price fluctuations on different currency pairs.

Forex trading day in and day out denotes those positions that open and close within the same trading day with the goal of gaining profit on short-term price changes. There can be an enticing experience, although you realize the possible problems associated with it like the use of leverage, volatility, and the need for consistency and discipline.

Forex Day Trading Strategies

Forex day trading strategies can be broadly categorized into several types:

1. Trend-following Strategies

- Moving Average Crossovers: This strategy involves using two moving averages of different time periods to identify potential trend changes. Traders look for when a shorter-term moving average (e.g., 20-period) crosses above a longer-term moving average (e.g., 50-period) to signal a potential uptrend, and vice versa for a downtrend.

- Example: Let’s say you’re analyzing the EUR/USD 1-hour chart, and you notice that the 20-period moving average has crossed above the 50-period moving average. This could signal the start of an uptrend. Your entry criteria could be a candlestick close above both moving averages, with a stop-loss placed below the recent swing low.

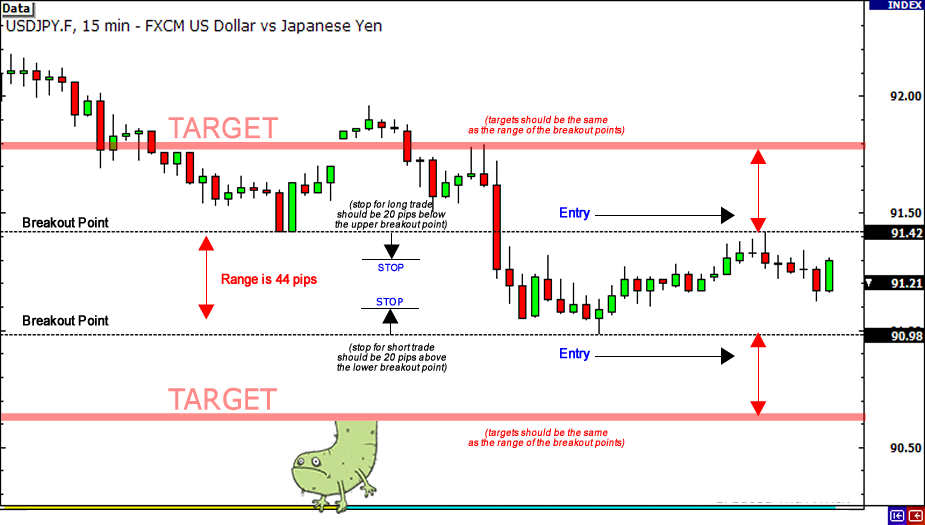

- Breakout Strategies: with this strategy, traders identify periods of consolidation and wait for a breakout from the trading range to signal a new trend. Entry criteria could be a candlestick close above/below the range, with a stop-loss placed just inside the range.

- Example: On the GBP/USD daily chart, you notice the price has been trading within a range of 1.2800 – 1.3200 for the past few weeks. You decide to wait for a breakout above 1.3200 to signal a potential uptrend. If the price closes above 1.3200, you could enter a long position with a stop-loss just below 1.3200.

- Momentum Indicators: Indicators like the Relative Strength Index (RSI) and Stochastic Oscillator can help identify the strength of a trend. Traders may look to enter in the direction of the trend when the indicator shows oversold (uptrend) or overbought (downtrend) conditions.

- Example: Let’s say you’re watching the USD/JPY 4-hour chart, and you notice that the price is in a strong uptrend. However, the RSI is showing a reading below 30, indicating oversold conditions. You could look for a bullish divergence between price and the RSI, and enter a long position if the RSI starts to turn upwards while the price continues to rise.

2. Range-trading Strategies

- Support and Resistance: Traders identify horizontal levels where the price has consistently bounced or reversed in the past. Entry criteria could be a candlestick rejection or reversal pattern at these levels, with a stop-loss placed just beyond the level.

- Example: On the AUD/USD daily chart, you notice that the price has repeatedly bounced off the 0.7500 level over the past few months, acting as a strong support level. You could wait for the price to approach 0.7500 again, and look for a bullish reversal candlestick pattern like a hammer or morning star to enter a long position, with a stop-loss placed just below 0.7500.

- Pivot Points: Calculated levels based on the previous day’s high, low, and close can act as support and resistance areas for the current day. Traders may look to buy near support pivots and sell near resistance pivots.

- Example: You’re analyzing the EUR/GBP 1-hour chart, and you’ve calculated the pivot points for the current trading session. You notice that the price is approaching the R1 (first resistance) pivot level, and you decide to wait for a bearish rejection candlestick pattern at this level to enter a short position, with a stop-loss placed just above R1.

- Channel Trading: Traders identify parallel trendlines that contain the price action, creating a channel. Entry criteria could be a bounce off the channel boundaries, with a stop-loss placed just beyond the channel lines.

- Example: On the NZD/USD 4-hour chart, you’ve identified a descending channel pattern, with the price bouncing between the upper and lower trendlines. You could wait for the price to approach the lower trendline and look for a bullish reversal candlestick pattern to enter a long position, with a stop-loss placed just below the lower trendline.

3. Price Action Strategies

- Candlestick Patterns: Patterns like engulfing, hammer, shooting star, and doji can signal potential reversals or continuations. Entry criteria could be the formation of the pattern, with a stop-loss placed just beyond the pattern’s boundary.

- Example: You’re watching the USD/CAD 1-hour chart, and you notice a bearish engulfing candlestick pattern forming at the end of an uptrend. This could signal a potential reversal. You could enter a short position after the engulfing candlestick closes, with a stop-loss placed just above the high of the engulfing candlestick.

- Price Formations: Traders look for patterns like head and shoulders, triangles, wedges, and flags to identify potential breakout or reversal points. Entry criteria could be a breakout from the formation, with a stop-loss placed just inside the pattern.

- Example: On the GBP/JPY daily chart, you’ve identified a bullish symmetrical triangle pattern forming over the past few weeks. You could wait for a breakout above the upper trendline of the triangle to enter a long position, with a stop-loss placed just below the recent swing low inside the triangle.

4. Technical Indicator Strategies

- Relative Strength Index (RSI): The RSI oscillates between 0 and 100, with readings below 30 considered oversold (potential buy signal) and above 70 considered overbought (potential sell signal). Traders may look for divergences between price and the RSI to identify potential reversals.

Example: You’re analyzing the EUR/USD 4-hour chart, and you notice that the price has been making higher highs, but the RSI has been making lower highs, indicating a potential bearish divergence. You could wait for the RSI to cross below 70 (overbought) and enter a short position, with a stop-loss placed above the recent swing high.

- Stochastic Oscillator: Similar to the RSI, the Stochastic Oscillator measures momentum and can signal overbought or oversold conditions. Traders may look for crossovers between the %K and %D lines for potential entry signals.

- Example: On the AUD/NZD daily chart, you notice that the %K line has crossed above the %D line while the Stochastic Oscillator is in oversold territory (below 20). This could signal a potential bullish reversal. You could enter a long position after the crossover, with a stop-loss placed below the recent swing low.

- Moving Average Convergence Divergence (MACD): The MACD is a trend-following indicator that can signal potential trend changes through crossovers of the MACD line and signal line. Traders may look to enter in the direction of the crossover.

- Example: You’re watching the USD/CHF 1-hour chart, and you notice that the MACD line has crossed above the signal line, indicating a potential bullish trend change. You could enter a long position after the crossover, with a stop-loss placed below the recent swing low.

5. News Trading Strategies

- Fundamental Analysis: Traders analyze economic data, central bank policies, and other fundamental factors to anticipate potential market reactions and trade accordingly.

- Example: The US non-farm payrolls report is due for release, and economists are forecasting a strong number, indicating a healthy job market. You could anticipate that this could lead to a potential strengthening of the US dollar, and plan to enter long positions in USD currency pairs if the number meets or exceeds expectations.

- News Spike Trading: Traders look for sharp price spikes or gaps immediately following news releases and aim to capitalize on the initial volatility by entering in the direction of the spike and setting a tight stop-loss.

- Example: The Bank of England has just announced an unexpected interest rate hike, and you notice a sharp spike upwards in the GBP/USD currency pair. You could enter a long position in the direction of the spike, with a tight stop-loss just below the spike low, aiming to capture a portion of the initial volatility.

- News Fade Trading: Alternatively, traders may look to fade or counter the initial news-driven move, anticipating a potential retracement or reversal.

- Example: The European Central Bank has just announced a dovish monetary policy statement, and you notice the EUR/USD currency pair has gapped lower on the news. However, you anticipate that the market may have overreacted, and you could look to enter a long position, fading the initial move, with a stop-loss placed below the recent swing low.

Scalping Strategies

- Bid-Ask Bounce: Scalpers look for when the price bounces off the bid or ask levels and enter in the opposite direction, aiming for a small profit target.

- Example: You’re watching the EUR/USD 1-minute chart, and you notice that the price has just bounced off the ask level (the selling price). You could enter a short position at the ask level, with a tight stop-loss just above the recent swing high, and a small profit target of a few pips.

- One-Minute Scalping: Traders analyze 1-minute candlestick charts and look for specific patterns or setups to enter and exit trades within a few minutes or even seconds.

- Example: On the GBP/USD 1-minute chart, you notice a bullish engulfing candlestick pattern forming after a brief downtrend. You could enter a long position after the engulfing candlestick closes, with a stop-loss placed just below the low of the pattern, and a profit target of a few pips.

Conclusion

Forex day trading offers exciting opportunities for potential profits, but it also requires a significant commitment to education, risk management, and disciplined trading practices. By mastering effective trading strategies, implementing robust risk management techniques, and cultivating a resilient trading mindset, beginners can increase their chances of success in the fast-paced world of forex day trading.