| PROS | CONS |

|

|

Oanda offers flexible leverage options for traders, allowing them to amplify their trading positions. Leverage ratios vary depending on the instrument traded and the account type.

Summary table

| 📅 Year founded | 1996 |

| 📈 Demo account | Yes |

| 💰 Maximum leverage | 1:100 |

| 💵 Minimum deposit | $0 |

| 🗂️ Deposit options | Visa, Mastercard, Bitcoin, Ethereum, Altcoins |

| 🧰 Tradeable assets offered | Forex and CFD trading, over 100 instruments, including currency pairs, indices, commodities, bonds and metals, futures trading, commodities futures |

| 💬 Languages | 9 languages |

| 📧 Customer service hours | 24/7 |

| 💻 Platforms | Oanda trade, MT4, MT5 |

Accounts at Oanda

Oanda provides various account types to cater to different trading needs, including standard accounts, premium accounts, and corporate accounts. Each account type may have distinct features, benefits, and minimum deposit requirements.

Account types

| Feature | Standard account ($) | Elite Trader loyalty program ($) |

|---|---|---|

| Minimum volume trading requirement | ✗ | From 10M |

| Rebate per million traded | ✗ | From $5 |

| 68 FX pairs | ✓ | ✓ |

| Dedicated relationship manager | ✗ | ✓ |

| OANDA Web platform and mobile and tablet apps, plus TradingView and MT4 | ✓ | ✓ |

| Monthly TradingView subscription reimbursement | ✗ | ✓ |

| Unlimited free wire transfers | ✗ | ✓ |

| Core pricing + commissions | ✓ | ✓ |

| Spread-only pricing | ✓ | ✓ |

| API trading | ✓ | ✓ |

| 24/5 support | ✓ | ✓ |

| Variable contract sizes (as low as 1 unit) | ✓ | ✓ |

| MT4 open order indicator | Updates every 20 minutes | Updates every 5 minutes |

| Priority service queues | ✗ | ✓ |

Instruments at Oanda

Oanda offers a wide range of trading instruments across multiple asset classes, including forex currency pairs, commodities, indices, and precious metals.

Fees at Oanda

Oanda’s fee structure includes spreads, commissions, and financing rates. Spreads are variable and competitive, while commissions may apply to certain trading accounts or instruments. Financing rates are relevant for traders holding positions overnight.

Spreads at Oanda

Oanda offers competitive spreads, which may vary depending on market conditions, liquidity, and the trading platform used. Typically, major currency pairs have tighter spreads compared to exotic pairs.

Deposits and Withdrawals at Oanda

Oanda supports multiple deposit and withdrawal methods, including bank transfers, credit/debit cards, and electronic payment processors. Deposits are usually processed promptly, while withdrawal processing times may vary depending on the chosen method and regulatory requirements.

|

Special promo code → Iqcent – IC150 |

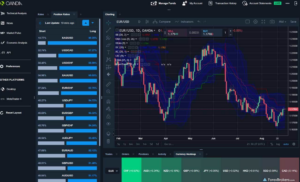

Oanda offers a proprietary trading platform called Oanda Trade, which is available in web and mobile versions. The platform is user-friendly and equipped with advanced charting tools, technical indicators, and risk management features. Additionally, traders can access the MetaTrader platform offered by Oanda.

Customer Support at Oanda

Oanda provides customer support through various channels, including email, live chat, and phone support. Their support team is available during market hours to assist traders with account-related inquiries, technical issues, and trading-related questions.

Conclusion

Overall, Oanda is a reputable online broker known for its transparent pricing, extensive range of tradable instruments, and user-friendly trading platforms. With competitive spreads, flexible leverage options, and robust customer support, Oanda remains a popular choice among traders worldwide. However, traders should carefully consider their trading objectives, risk tolerance, and regulatory requirements before choosing Oanda or any other broker for their trading activities.

FAQs about Oanda:

1. What is the minimum deposit required to open an account with Oanda?

There is no fixed minimum deposit requirement at Oanda. Traders can start with an amount that suits their budget and trading preferences.

2. What types of accounts does Oanda offer?

Oanda offers various account types, including standard accounts for individual traders, premium accounts with additional features, and corporate accounts for businesses.

3. How can I deposit funds into my Oanda account?

Oanda supports multiple deposit methods, including bank transfers, credit/debit cards, and electronic payment processors. Traders can choose the method that best suits their needs.

4. Are there any fees for depositing or withdrawing funds?

Oanda does not charge fees for deposits, but there may be fees associated with certain withdrawal methods. Traders should check the fee structure and terms for their chosen payment options.

5. What trading instruments are available at Oanda?

Oanda provides a wide range of trading instruments, including forex currency pairs, commodities, indices, and precious metals. Traders can diversify their portfolios across various asset classes.

6. How is leverage handled at Oanda?

Oanda offers flexible leverage options, and the leverage ratio may vary based on the trading instrument and account type. Traders should carefully consider their risk tolerance when using leverage.

7. Can I access Oanda’s trading platform on mobile devices?

Yes, Oanda offers a mobile version of its trading platform, allowing traders to access the markets, monitor their positions, and execute trades on the go.

8. Does Oanda provide educational resources for traders?

Oanda offers educational resources, including webinars, tutorials, and market analysis, to help traders enhance their knowledge and skills in the financial markets.

9. Is customer support available during weekends?

Customer support at Oanda is typically available during market hours. Traders can contact support through email, live chat, or phone for assistance with account-related queries or technical issues.

10. Can I use expert advisors (EAs) on Oanda’s trading platform?

Yes, Oanda supports the use of expert advisors (EAs) on its MetaTrader platform, providing automated trading capabilities for algorithmic traders.