Table of Contents

ToggleSwissquote is a Swiss-based online bank and financial services provider that offers a wide range of financial products and services, including online trading and investment services. It is one of the leading Swiss banks known for its strong reputation and regulatory compliance. Here’s an overview of Swissquote, including its pros and cons:

Pros of Swissquote

- Regulation and Safety: Swissquote is regulated by the Swiss Financial Market Supervisory Authority (FINMA), making it one of the most trusted and well-regulated financial institutions. Client funds are held in segregated accounts for added security.

- Wide Range of Instruments: Swissquote offers a comprehensive selection of financial instruments, including forex currency pairs, commodities, indices, stocks, bonds, cryptocurrencies, and more. This allows traders and investors to diversify their portfolios.

- Multiple Account Types: Swissquote typically offers various account types to cater to different trading and investment needs, including standard accounts, premium accounts, and professional accounts.

- Competitive Spreads: Swissquote is known for offering competitive spreads, especially in the forex market, making it attractive to cost-conscious traders.

- Research and Analysis: The broker provides extensive research and analysis tools, including daily market analysis, economic calendars, and trading ideas to assist traders in making informed decisions.

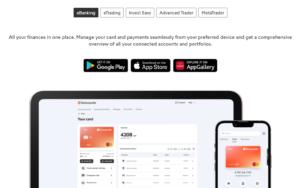

- Trading Platforms: Swissquote offers access to various trading platforms, including its proprietary Advanced Trader platform, MetaTrader 4 (MT4), and MetaTrader 5 (MT5).

- Investment Solutions: In addition to trading, Swissquote offers investment solutions such as robo-advisory services and savings accounts, allowing clients to invest in a diversified portfolio managed by experts.

- Education: Swissquote may offer educational resources, including webinars, video tutorials, and educational articles to help traders and investors enhance their knowledge and skills.

Cons of Swissquote

- High Minimum Deposit: Swissquote may require a relatively high minimum deposit to open an account, which could be a barrier for some traders, especially beginners.

- Inactivity Fees: The broker may charge inactivity fees for accounts that remain dormant for an extended period.

Leverage

Leverage levels at Swissquote vary depending on the regulatory jurisdiction and the type of financial instrument traded. Swissquote adheres to Swiss regulations, which impose strict leverage limits for retail traders.

Accounts

Swissquote typically offers various account types, including standard accounts, premium accounts, and professional accounts, each with its features and benefits.

Instruments

Swissquote provides access to a wide range of financial instruments, including forex pairs, commodities, indices, stocks, bonds, cryptocurrencies, and more.

Fees

Fees at Swissquote may include spreads, commissions (for certain account types), overnight financing costs (swap fees), and inactivity fees.

Spreads

Swissquote is known for offering competitive spreads, particularly in the forex market. Spreads can vary depending on the account type and market conditions.

Deposits and Withdrawals

Swissquote typically offers various deposit and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets. Processing times and fees may vary depending on the chosen method.

Trading Platform

Swissquote provides access to multiple trading platforms, including its proprietary Advanced Trader platform, MetaTrader 4 (MT4), and MetaTrader 5 (MT5).

Customer Support

The broker usually offers customer support through various channels, including live chat, email, and phone support.

Education

Swissquote may provide educational resources to help traders and investors improve their knowledge and skills.

Conclusion

Swissquote is a reputable and well-regulated Swiss bank and online broker known for its extensive range of financial instruments, competitive spreads, and robust trading platforms. While it offers a wide range of services to meet the needs of traders and investors, potential clients should be aware of the minimum deposit requirements and potential inactivity fees. Additionally, traders should always consider their risk tolerance and conduct thorough research before trading with any broker.